Promoted by

Accounting firms are missing the opportunity to turn advisory work into a must-have compliance-based service offered to ALL business clients. A few simple processes can significantly help with this.

Promoted by

Accounting firms are missing the opportunity to turn advisory work into a must-have compliance-based service offered to ALL business clients. A few simple processes can significantly help with this.

There seems to be a well-established misconception that advisory work should be performed on the small group of 'A-type' clients from which a firm can make a decent return. Every firm has those clients, but many are missing the opportunity to turn advisory work into a must-have compliance-based service offered to ALL business clients. By implementing some simple processes your firm will:

How do you achieve this?

Using online software such as Cash Flow Story, the process simplifies right down to the following:

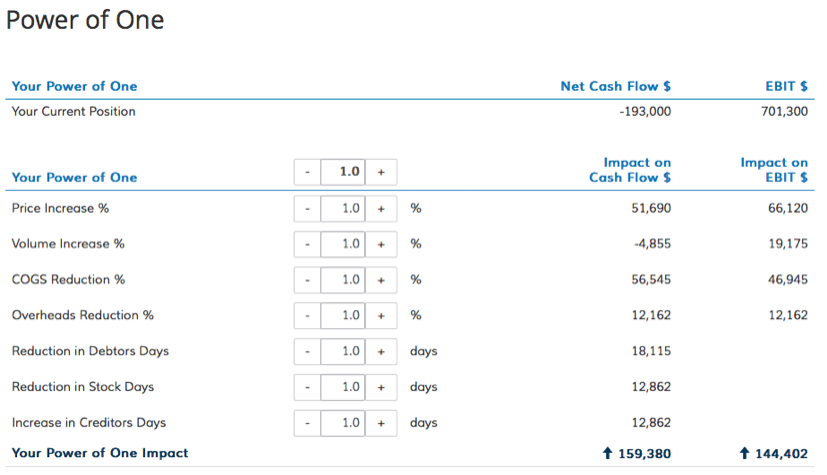

The Power of One table below shows your client how they can improve their cash flow and profit by making some small changes to their seven business drivers. With Cash Flow Story you can agree on the strategies with your client and show them instantly how those small changes can improve their businesses.

The entire process will take you around 15 minutes. When you see your client, simply open Cash Flow Story on your laptop, iPad or tablet and have a Power of One improvement conversation with them. In around five minutes you can help them set up some small improvements to key drivers in their business. Creating clear, consistent, achievable goals together will not only help improve their business, but give you the opportunity for regular, ongoing advisory discussions, possibly even converting them into A-type clients in the longer term.

Not only is the process outlined above chargeable, but even more importantly it starts your journey into advisory with a client by showing them how they can improve their profit, cash flow and, ultimately, the value of their business. What client doesn’t want to know that? As an adviser, you can use Cash Flow Story to connect that desire for knowledge with a simple, easy to understand process to help them achieve their dreams and aspirations within their business.

To find out more about Cash Flow Story go to www.cashflowstory.com or call Joss on 0417 892 088.

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login

You are not authorised to post comments.

Comments will undergo moderation before they get published.