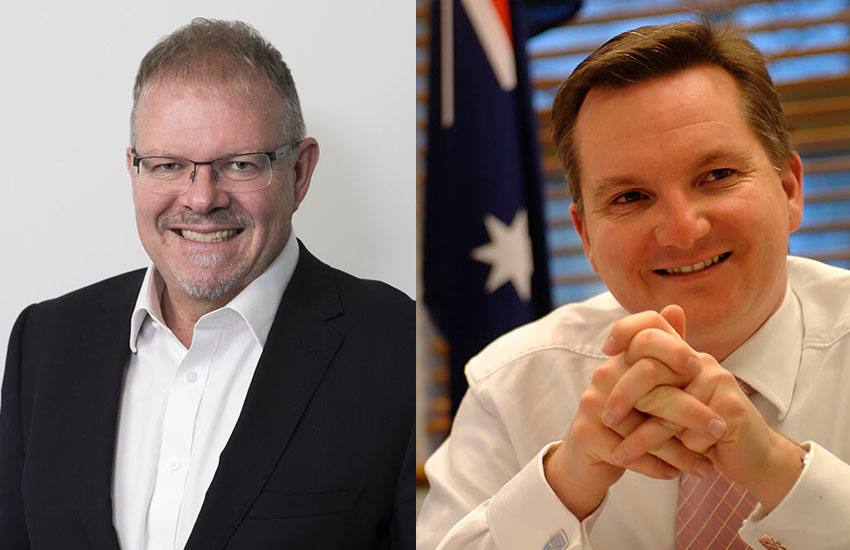

Shadow treasurer Chris Bowen has announced Labor’s plans to push through with the second tranche of the anti-money laundering and counter-terrorism financing (AML/CTF) legislation, bringing accountants, lawyers and real estate agents into the regime.

The AML/CTF regime currently covers the banks, casinos and financial service providers, who are required to report suspicious transactions.

You’re out of free articles for this month

Work to bring accountants, lawyers and real estate agents under the regime were stalled by the government last year, with Labor now set to use this as an election campaign issue to combat criminals who use “dirty money” from crime proceeds, pass it through legitimate businesses to turn it into “clean money”.

“The government has completely dropped the ball on money laundering reform. According to the government’s own work plan, real estate agents should already be covered by our money laundering laws. The Liberals have done nothing to progress this,” said Mr Bowen.

While recognising the need to deter and disrupt money laundering in the country, CPA Australia’s general manager of external affairs said a new regime for the industry would need to be carefully managed to soften the regulatory burden and cost of firms.

“We not support the holus-bolus extension of the existing obligations under the AML/CTF act to all accountants,” said Mr Drum.

“The ongoing compliance costs associated with extending all existing AML/ CTF obligations on all members of the accounting profession significantly outweigh the risks.

“The current obligations under the act are primarily designed to counter risks in large financial institutions. These obligations are expensive and difficult to comply with, especially for smaller businesses.”

Mr Drum said accountants who are members of a professional accounting body should also receive concessions because of the overlapping professional requirements that they are required to adhere to, including undertaking client due diligence.

Instead, Mr Drum believes an alternative approach would be to impose AML/CTF obligations to accountants should they be found to be in breach of the act.

Mr Drum had earlier highlighted the rising cost of doing business in the industry, taking aim at ASIC’s industry funding model and last year’s TPB registration price hike.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Jotham Lian

AUTHOR

Jotham Lian is the editor of Accountants Daily, the leading source of breaking news, analysis and insight for Australian accounting professionals.

Before joining the team in 2017, Jotham wrote for a range of national mastheads including the Sydney Morning Herald, and Channel NewsAsia.

You can email Jotham at: This email address is being protected from spambots. You need JavaScript enabled to view it.

Login

Login