How every accountant can be a step ahead when your client is selected for an audit relating to the black economy or on rental property-related expenses

BusinessPromoted by Accountancy Insurance.

The ATO has been focussing heavily on the Black Economy and on excessive rental property related expenses in 2019 and will continue this into 2020. There are ways you can ensure that your firm doesn’t end up financially worse off as a result of your client being selected by the ATO for an audit.

The Black Economy Taskforce

It is said that cash is king, or at least it was. But does that really hold true in our modern economy? Is cash really the best form of payment or could it be contributing to your business clients being flagged for additional audit activity with the ATO or other government revenue authorities?

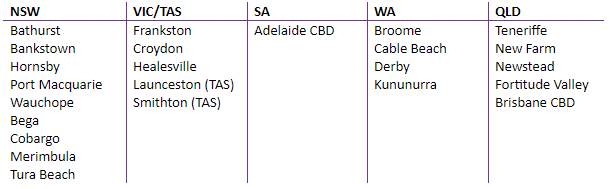

The Black Economy Taskforce was established in 2016 to combat the Black Economy in Australia but it is only recently that it has been so widely broadcast in the media following the ATO’s Black Economy Taskforce roadshow announcement. We all know the song “I’ve been everywhere man…” and the ATO is doing their best to ‘go everywhere’ too with a goal of visiting up to 10,000 businesses during the current financial year. These are just a few of the places that they have visited already:

Accepting cash as payment is legitimate however the ATO has benchmarks that it uses to determine if a business is not declaring all of their income. Businesses that do not comply may find themselves being selected for an audit.

As an advisor to your business clients you will already have your own recommendations for what they should do to avoid being flagged but as outlined in the Budget Review 2018-19 some examples of Black Economy activities that the ATO is focussed on include; reporting or under-reporting income, paying for work cash-in-hand, underpayment of wages and superannuation guarantee, GST fraud, motor vehicle fraud, and Australian Business Number (ABN) fraud.

Rental property related expenses and the sharing economy

It can often be an honest mistake; it is the festive season or one of your client’s children has recently moved out of home and they rent out their bedroom on Airbnb. But they forget to declare the additional income and they suddenly get flagged by the ATO.

The ATO has made it very clear that they want all taxpayers to be aware that income earned through sharing-economy services like Airbnb must be declared and failing to do so could cost them more than the extra income that they earned from renting out the room. This can be frustrating for your clients and can lead to a lot more work on your behalf when the ATO does catch up with them and starts making their enquiries which could inevitably lead to an audit.

There is sophisticated data-matching technology that the ATO utilises to review holiday houses rented on websites such as Stayz and Airbnb. This is especially important when taxpayers need to prove that their holiday home was not used for private purposes when a deduction is being claimed. In fact, the ATO uses a range of third party information including; data from financial institutions, property transactions, rental bonds, and online accommodation booking platforms, in combination with sophisticated analytics to scrutinise every tax return.

The ATO has also communicated openly their intent to significantly increase the number of audits it conducts in relation to rental property claims with respect to capital works, capital assets, or other rental property related expense claims. Much like a client over claiming WREs the ATO has benchmarks that it uses to compare what is acceptable for rental property claims.

Be a step ahead

To help avoid fee write-offs when the wave of audits start coming in, speak to the team at Accountancy Insurance about Audit Shield.

Audit Shield is the no net cost/no loss solution to ensure your professional fees will be covered in the event of ATO and other government revenue authority initiated client audit activity. It also means that you can avoid the awkward conversation concerning additional fees incurred when dealing with audit activity with your client.

To find out more about Audit Shield visit the Accountancy Insurance website or call our team on 1300 650 758.

You are not authorised to post comments.

Comments will undergo moderation before they get published.