Promoted by ATOmate

26 June 2025

New Broker Academy 2025

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREPromoted by ATOmate

If you and your team have been working from home recently, you’ve no doubt uncovered more than a few processes in your business that have needed a bit of tinkering to serve you in a remote world. Don’t stop now – automating key business processes is a great way to maintain efficiency and improve productivity for your entire team – no matter their location. Here are our three tips to help you do so successfully, and the perfect process to get started with.

1. Choose wisely

Just because you can automate a task, doesn’t mean that you should. If a process only has one or two steps, or requires creative input, attempting to automate it may be more of a hinderance than a help. Look out for processes that involve a number of steps and/or people, that are prone to data entry or human errors, and that often lead to inconsistent outcomes. The processing and distribution of ATO correspondence, updating client details and email addresses between your Practice Management system and marketing platform, or the collation of annual tax returns & financial statements are all repetitive, error prone processes that make them the perfect candidates for automation.

2. Map it out

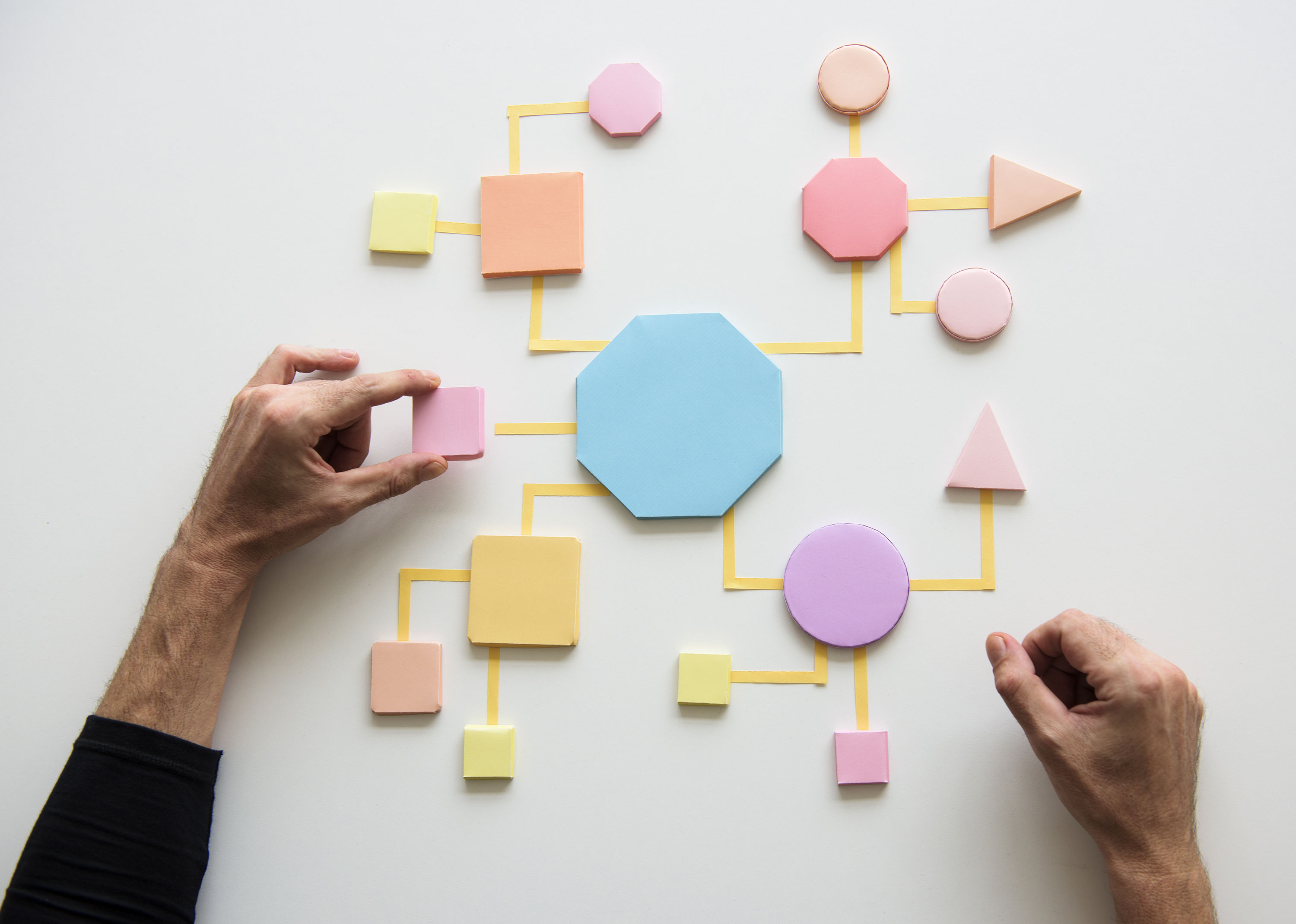

Before hastily signing up to a silver bullet, or turning a tried and true process on its head for the sake of automation, ensure you have complete clarity over the process. Often we’re only involved in certain aspects of a task (approving documents or preparing correspondence), so make sure you get all stakeholders around the table to map out what the process currently looks like, what the automation implementation plan is, and what will determine the project’s success. It’s also a good idea to assign specific deadlines and responsibilities to ensure you stay on track. If you’re working with a software provider to help implement your automation, ask them for an implementation timeline and even get their thoughts on how they have helped other clients adapt their processes to the automation.

3. Lead with purpose and perspective

There is no denying change is hard. So before embarking on a significant automation make sure you have buy-in from your team. Get them involved in helping to identify to opportunities for automation within the business (try asking them to list the processes that frustrate them the most), call for a project team and/or project champion to manage the roll-out, and ensure they have visible support from management to successfully implement the change.

4. Bonus tip: Start with the low hanging fruit & cut your ATO document processing time by 90%

Successfully automating key processes within your practice will free your team members up to focus on what is most important: the relationships you have with your clients. If you’re looking for an automation that takes little effort to implement but that will have a big impact on your business, consider automating the processing and distribution of your ATO correspondence. It’s a clunky, cumbersome, and repetitive process that’s prone to data entry errors – making it the prime candidate for automation.

ATOmate automates the bulk download of notices from the Tax Agent Portal, as well as the processing, checking and distribution of documents including Notices of Assessment, Statements of Account and Tax Debts. Not only does ATOmate reduce manual data entry and processing time, it’s also designed to help you keep up with compliance requirements – automatically redacting TFNs to keep your client’s data safe and secure.

With ATOmate, you can reduce your ATO document processing time by 90%. It’s never been more important to reclaim the valuable time you and your team are spending on repetitive administrative processes and reinvest that into building and maintaining meaningful client relationships and growing your business. Find out more about ATOmate here or register for an online discovery session here.

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login

You are not authorised to post comments.

Comments will undergo moderation before they get published.