With accounting services not listed as a permitted activity, tax professionals will not be allowed to apply for the permitted worker scheme to allow employees to travel to work.

You’re out of free articles for this month

Businesses and individuals risk a $99,132 and $19,926 fine, respectively, for issuing worker permits to employees who do not meet the requirements of the worker permit scheme or who otherwise breach the scheme requirements.

However, with restrictions set to last for at least six weeks, practitioners now face an unenviable task of assisting clients without access to physical files and mail.

As such, the 11 professional accounting and bookkeeping bodies forming the National Tax Liaison Group and the Tax Practitioners Stewardship Group have now urged Mr Andrews to grant tax professionals access to the permitted worker scheme to travel to their own practices or their clients’ business premises to access crucial physical documents.

These include client files, working papers and mail, including ATO correspondence and time-critical letters.

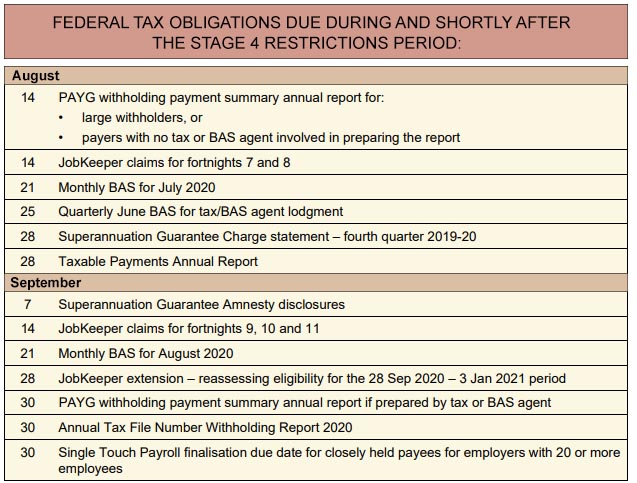

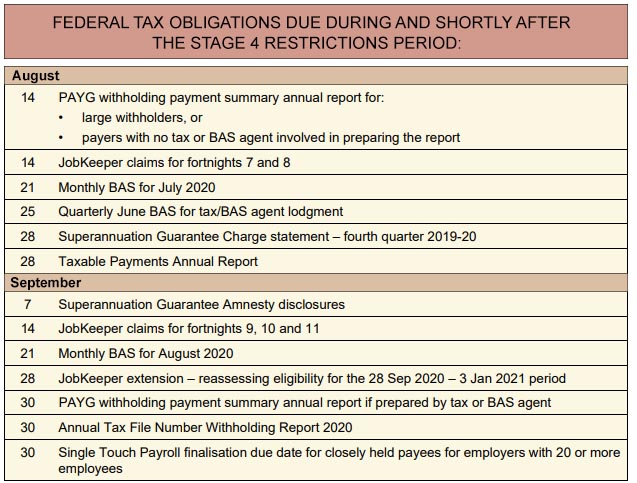

“For some tax practitioners and their clients, these restrictions will result in an inability to access time-critical tax advice, lodge obligations on time (e.g. payment summaries) or make payments on time (e.g. payment notices such as notices of assessment for clients could go unopened for six weeks, extending beyond the due date of the payment),” the joint bodies said.

“Also, some may miss out on stimulus payments (e.g. not claiming JobKeeper on time) and suffer significant penalties (e.g. where they are unable to access the superannuation guarantee amnesty).”

Access to the permitted worker scheme has also been requested for professionals to attend client business premises where that business is a permitted activity, or to attend business premises to appear in courts, tribunals or remotely for tax-related legal proceedings.

Accountants specialising in insolvency and performing duties which require them to take possession of business assets and premises should also be allowed to be granted a movement permit, according to the joint bodies.

The Victorian government has also been urged to clarify its position on sole operators, with its latest guidance noting that sole operators “can continue to operate, if they do not have contact with the public, or with people other than those persons living in their primary household”.

The 11 bodies include CPA Australia, Chartered Accountants Australia and New Zealand, the Corporate Tax Association, the Institute of Public Accountants, Law Council of Australia, the Tax Institute, the Institute of Certified Bookkeepers, Tax & Super Australia, National Tax and Accountants’ Association Ltd, Australian Bookkeepers Association and Association of Accounting Technicians.

While an earlier plea to include tax professionals as an essential service had been ultimately unsuccessful, the joint bodies are hopeful that the workaround arrangements will be considered by the Victorian government.

“Accountants and bookkeepers will be critical to the government and business sector over the coming weeks to ensure the delivery of economic support and to assess business viability. Businesses are far more likely to turn to their accountant than any other source to guide them through this current crisis and beyond,” the joint bodies said.

“We believe it is important to recognise the valuable frontline role tax practitioners play in ensuring the collection of revenue and disbursement of government payments in a timely and orderly manner, in addition to the advisory services they are providing to businesses in financial distress as a result of the stage 4 restrictions.

“There are significant risks to the economy, the business operating environment, and the tax and superannuation systems if they are unable to operate.”