[Free eBook] How to revolutionise your client engagements

BusinessPromoted by Practice Ignition

Understanding the importance of client engagements written by Head of Accounting, Rebecca Mihalic, Practice Ignition.

Have you ever had a fee dispute with one of your clients?

Have they ever been unhappy with the services that you’ve provided or the timeline that it’s taken to complete them?

If so then don’t worry — the vast majority of accountants have been in this very same position. But as it turns out, there’s an easy remedy to these all-too-common problems: client engagements.

As an accountant and a tax agent, I know that most of the rules surrounding client engagement come more under the ‘best practice’ bracket than necessarily being legal requirements (unless you’re an auditor, of course).

I also know that an engagement can take many forms—it can be a letter, a contract, a brochure, an email, or various other forms of written communication. But in my 15 or so years of working in public practice, I’ve found one thing to be true: in all circumstances, the best practice is to have a documented letter of engagement that’s signed by both you and your client. Not only is this an important first step in the relationship, but it’s a great way for both parties to manage expectations and responsibilities going forward.

Let’s start with the basics

What is an engagement?

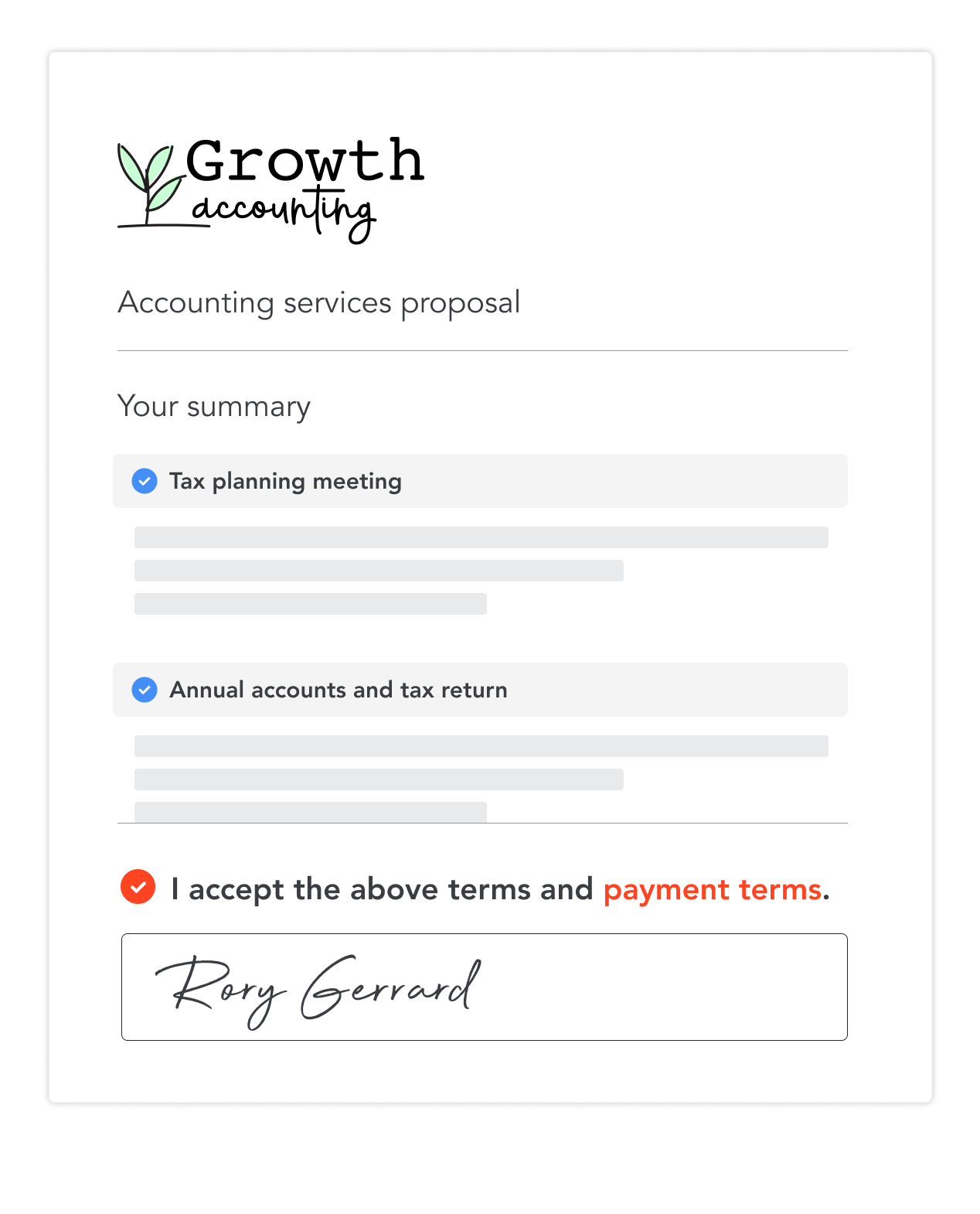

Quite simply, an engagement is a tool that’s used to document and communicate the terms of your services with your clients. Your engagement should clearly set out the services that you’re expected to provide, how often they will be provided, and who is ultimately responsible for what (and when).

Who governs and guides what needs to go in my engagement letter?

This will vary depending on your own registrations, but broadly speaking, accountants in public practice are guided by the Accounting Professional & Ethics Standard Board APES 305 Terms of Engagement and Tax Agents and BAS Agents are guided by the Tax Practitioners Board TPB(PN) 3/2019. Some people will find themselves having guidance from multiple places, however even when this occurs, there’s generally little conflict between the different sets of guidance.

Find out more about the Tax Practitioners’ guidance on engagement letters by downloading the full eBook below.

Why do I need to engage?

Broadly speaking, you need to engage all of your clients

For example, separate letters should be issued if you provide tax services to both:

- a husband and wife

- a partnership and the individual partners

- a company and its shareholders

- a company and its directors

- the trustees of a settlement and its beneficiaries.”

The Tax Practitioners Board currently gives no guidance on what constitutes an appropriate agreement to engage entities together, and who would need to sign this engagement.

How often do I need to engage my clients?

Both the Tax Practitioners Board and the Accounting Professional & Ethics Standard Board acknowledge that engagements can either be recurring or ongoing. Both also encourage producing a new engagement if there’s a change to the services being offered, or any other significant changes that will affect your work with the client in question. Further to this, The Tax Practitioners Board guidance is that engagements are to be reviewed and reconfirmed at least annually.

I’m not required to engage my clients—so should I still do it?

Take a moment to consider what an engagement letter contains and the many reasons why they’re useful. If you do, you’ll come to the same conclusion as me: they’re absolutely necessary. Think about any time you encountered a fee dispute, a client was upset about your service, or your work was impacted due to a client not providing you the required information. The vast majority of accountants have unfortunately had to go through these experiences before. Now consider how these issues could’ve been remedied upfront if only there had been a clear engagement detailing what was expected from each party. Client engagements will revolutionise the way that your practice operates. You’ll gain greater clarity, build stronger relationships, and will be more successful in the long run.

For the full eBook, links to specific TPB guidance, and resources to help you begin your journey,

See how Practice Ignition can help you save time and automate your engagement process:

Join our free webinar, Wednesday 19th August at 12pm or Start a free 14-day trial now

You are not authorised to post comments.

Comments will undergo moderation before they get published.