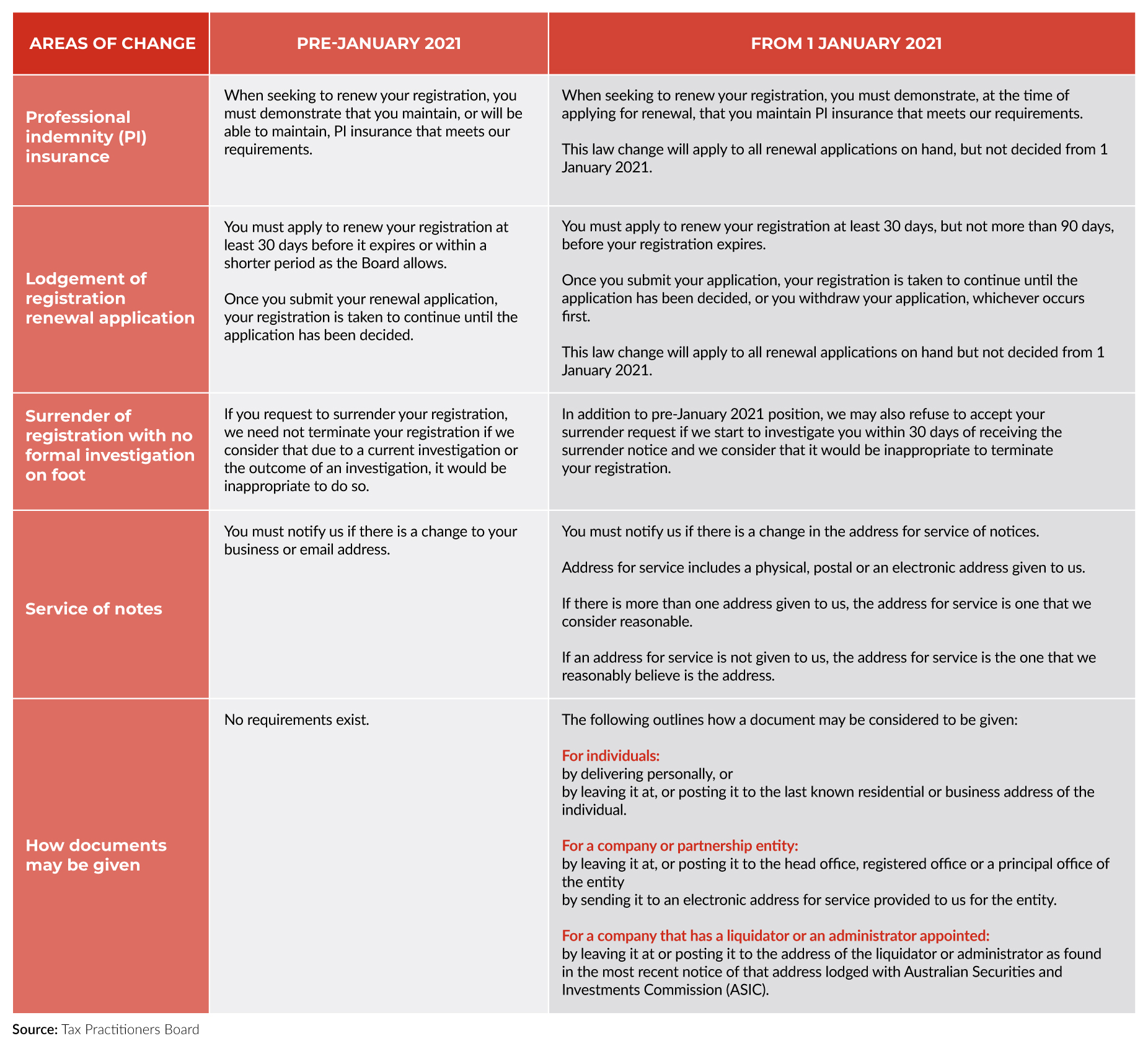

The Tax Practitioners Board is set to contact practitioners who have not updated their professional indemnity insurance details, following several law changes that kicked in over the new year.

26 June 2025

New Broker Academy 2025

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MORE

Login

Login