In the past two years we’ve experienced a phenomenal shift in the way the accounting industry works, with firms pivoting to enable remote working, virtual client meetings and facilitate higher levels of client service off the back of the global pandemic and the fast pace of change in tax legislation.

The remote or hybrid working model has delivered – and will continue to deliver – many benefits. However, it also comes with its own set of challenges; without a clear boundary between work time and home time, we are seeing less 9am - 5pm and a global spike in unpaid overtime hours. At the same time, with a global talent shortage underway, firms are understaffed and working longer hours, while also needing to spending time recruiting and training which leaves less time to focus on core work.

Work life balance: the number 1 challenge

Within this context it is perhaps unsurprising that work life balance amongst accountants has been a major challenge. In the Wolters Kluwer CCH 2022-23 Tax Season Challenges survey, over 400 firms were surveyed, and the biggest issue firms reported was: work-life balance.

The art of juggling your career and personal time with friends and family, whilst staying in good health, can be challenging. Ironically, technology, flexible schedules and the ability to work from any location has blurred the line between “work” and “life”, making it harder for people to really switch off from their work, even when it’s in their best interest to do so.

Due to the global talent shortage, accountants are needing to do more with less, and to do so without sacrificing work life balance, it means a shift from being “productive” (with good billable hours but working overtime) to “efficient” (completing the same tasks faster with the help of integrated technologies.)

Forty-six percent of firms report their major challenge is finding time to add value to their clients. But if accountants are struggling to find the hours in the day to complete fundamental compliance work, making time to generate advisory work can feel impossible.

Unified tools: time savings which add up

Based on our report findings, what is clear, is that workflow efficiency and planning for strategic business guidance is no longer a future goal but an essential service for firm growth and success – with a flow on effect to better work life balance.

Accounting firms are looking to their tech stack/software to help reclaim precious time at every step of their workflow.

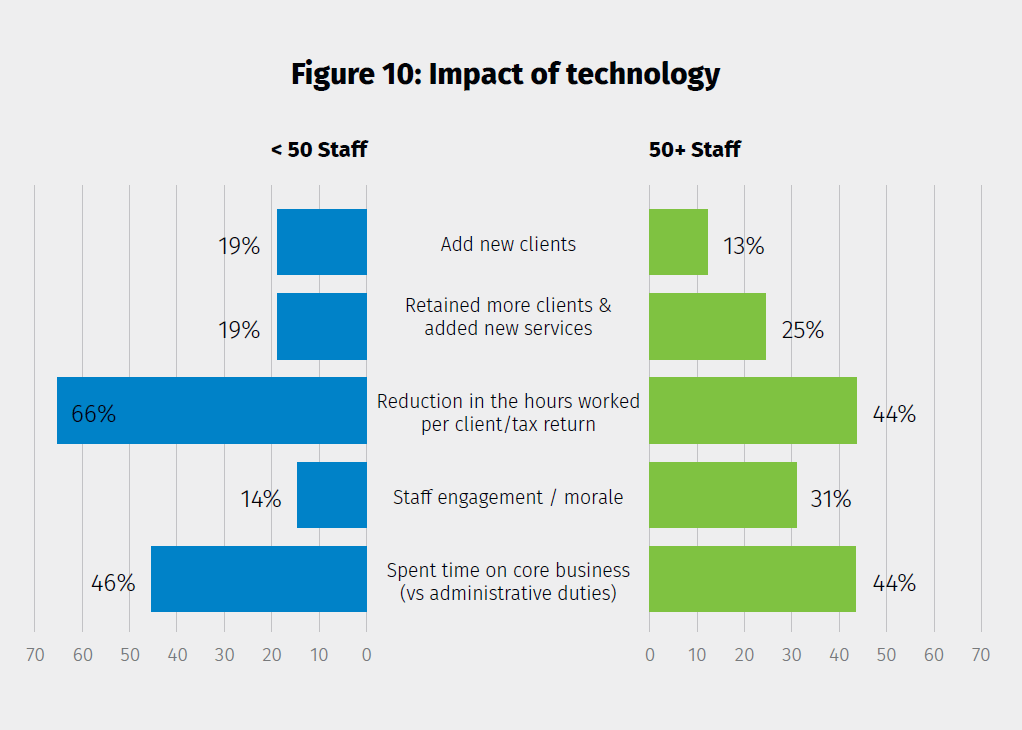

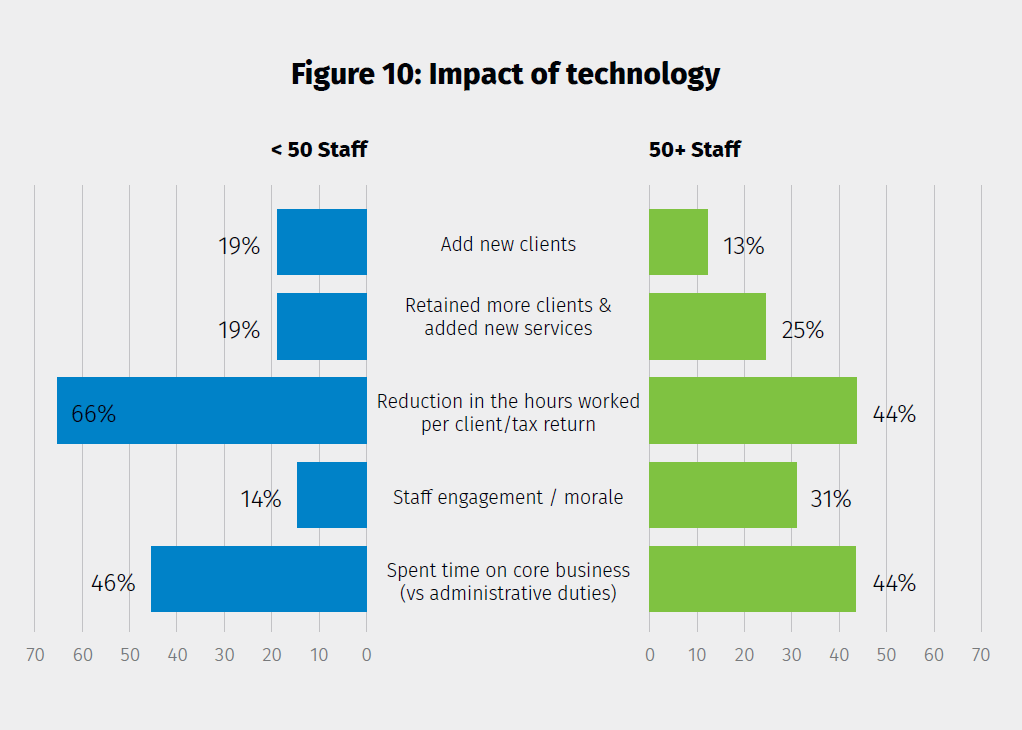

In fact, the biggest impact of technology for accounting firms was helping to reduce the time spent on tax returns. 66% of small firms and 44% of large firms find technology significantly reduces the number of hours spent per client/tax return.

Looking specifically at compliance software, over 76% of all firms stated the most important area when preparing a tax return is to prepare it with minimal data entry and clicks.

The fact is, the savings of a few minutes, and seconds with each click or step can add up to hours by the end of the day and whole days by the end of the month. Time which can be spent on value-add advisory and on a personal level, it could mean the ability to duck away for a run, or to log off and have dinner with your kids, or take the dog for a walk.

The power of integration

Interestingly, while firms value software integration (see figure below), many firms are still using three or more software providers to service their firm’s needs. However, the greatest workflow efficiency is really to be gained from a unified suite of tools that are designed to work with each other.

Integration is key to creating a modern, streamlined client experience and optimising firmwide team collaboration. This is why CCH iFirm, a unified suite of cloud tools, can deliver many time saving benefits. Individual modules for practice management, cloud document storage, client portal or tax all sit within the same platform, enabling an end-to-end workflow.

Further integration enhancements upcoming for our CCH iFirm Tax module with our Document Vault (cloud document management), Client Portal and Signatures are all designed to facilitate great automation through prefilling and mapping, minimise clicks, simplify workflow and ultimately reduce time spent in completing a tax return, getting it signed and saved in your centralised hub.

As a former accountant and now Product Manager of CCH iFirm tax and compliance software, I am a firm believer in harnessing the benefits of technology. Technology exists to make life easier, to make tasks faster, to help us connect better. If you make time to define your work life priorities, focus on what you can control and explore how the right technology can help to improve your current situation, then this is a big step in the right direction.

For more information on how the CCH iFirm platform can help you save time, request a demo.

Download our complimentary Wolters Kluwer CCH 2022-23 Tax Season Challenges Report

Written by Viraj Joshi, Product Manager – Professional Software Solutions, Wolters Kluwer APAC

Login

Login

You are not authorised to post comments.

Comments will undergo moderation before they get published.