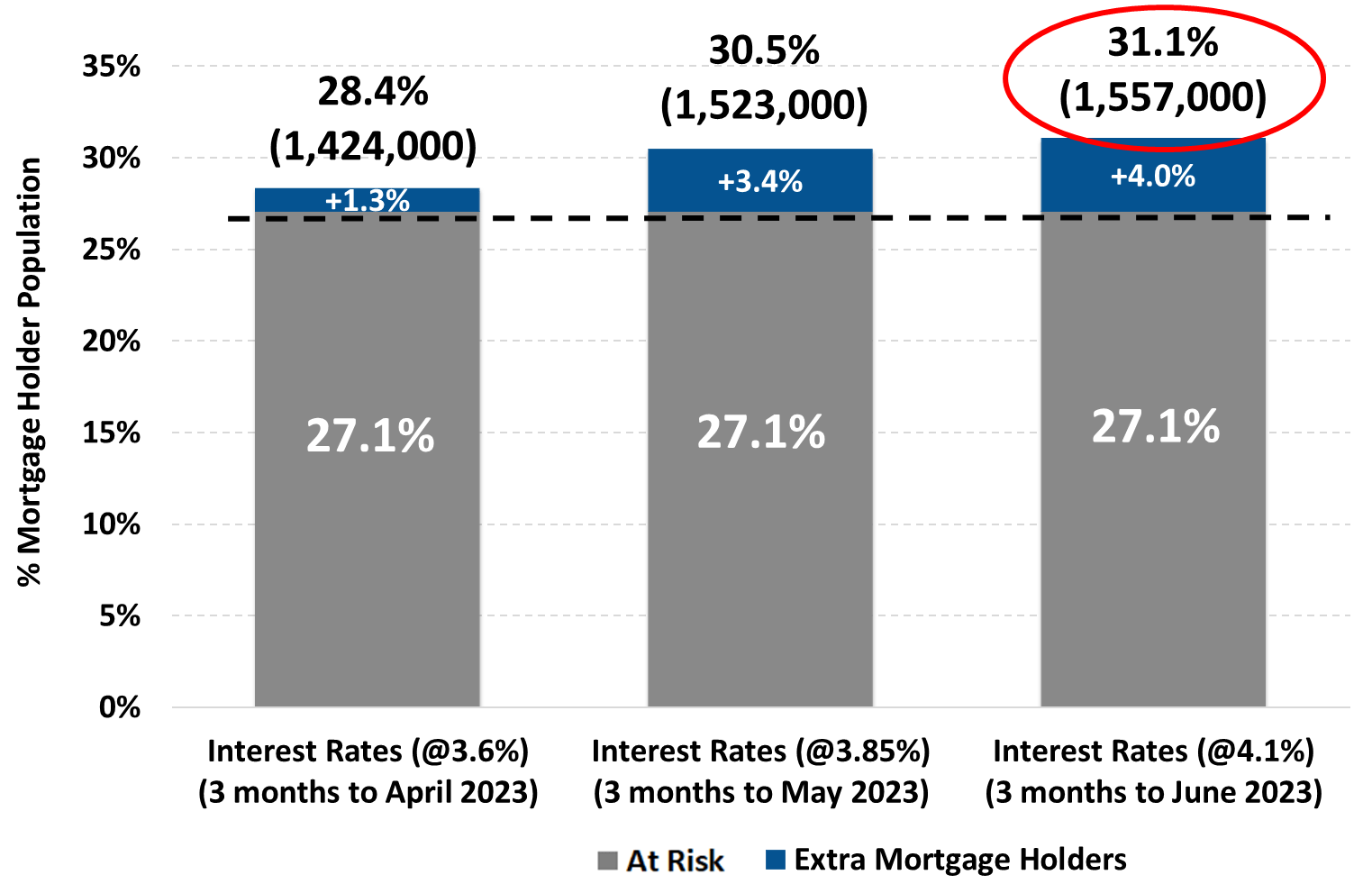

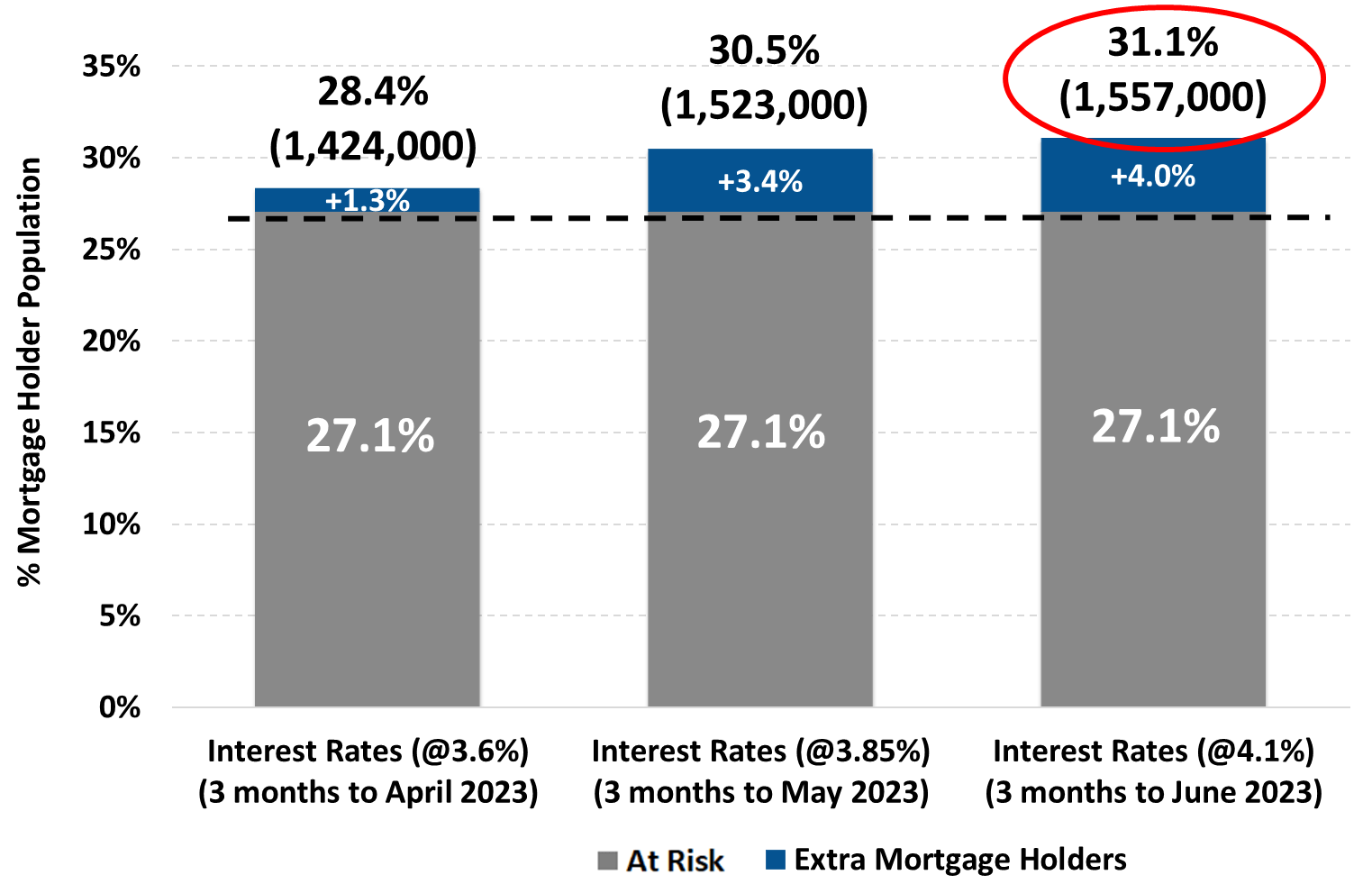

Mortgage stress has risen to the highest level in 15 years with more than one-quarter of debtors “at risk” according to the latest Roy Morgan research, and the number will hit a record level if the RBA lifts interest rates tomorrow.

The Roy Morgan survey estimated 1.35 million mortgage holders were on the brink – 27.1 per cent – a figure just shy of the 1.37 million at risk during the global financial crisis in September 2008.

You’re out of free articles for this month

The result comes on the eve of the next RBA decision about interest rates and shows the cumulative impact of 10 consecutive increases since May last year, with only one rise (by 0.25 points in March) during the survey period of Q1 2023.

Roy Morgan said the number “at risk of mortgage stress” had increased by 590,000 over the last year as official interest rates rose from 0.1 per cent to the highest level since June 2012, 3.6 per cent.

Roy Morgan CEO Michele Levine said an RBA decision to lift rates tomorrow would push a further 171,000 into mortgage stress.

“The latest figures show rising interest rates are causing a large increase in the number of mortgage holders considered ‘at risk’ and further increases will spike these numbers even further,” she said.

“If the RBA does raise interest rates again … Roy Morgan forecasts that mortgage stress is set to increase to over 1.5 million mortgage holders (30.5 per cent) considered ‘at risk’ by May 2023 – this would be a record high number.

“Of more concern is the rise in mortgage holders considered ‘extremely at risk' now estimated at 835,000 (17.3 per cent) in March 2023 – the highest for over a decade."

Roy Morgan said if the RBA went further and raised interest rates by 0.25 points in June to 4.1 per cent, there would be 1,557,000 mortgage holders at risk by June 2023 – an increase of 205,000.

Roy Morgan interviews an average of more than 2,700 people over each quarter for its survey. Mortgage holders are considered at risk if their mortgage repayments are greater than a certain percentage of household income, depending on income and spending. Extremely at risk means the proportion of household income is exceeded even if mortgage repayments are interest only.

Philip King

AUTHOR

Philip King is editor of Accountants Daily and SMSF Adviser, the leading sources of news, insight, and educational content for professionals in the accounting and SMSF sectors.

Philip joined the titles in March 2022 and brings extensive experience from a variety of roles at The Australian national broadsheet daily, most recently as motoring editor. His background also takes in spells on diverse consumer and trade magazines.

You can email Philip on: This email address is being protected from spambots. You need JavaScript enabled to view it.

Login

Login