The increasing popularity of buy now, pay later (BNPL) and unregistered credit services should be ringing alarm bells with both lenders and consumers, according to open banking technology provider Frollo.

Frollo research revealed a sharp rise in BNPL users over the past year to 32 per cent from 25 per cent and a “worrying” absence of credit checks or lender assessments.

You’re out of free articles for this month

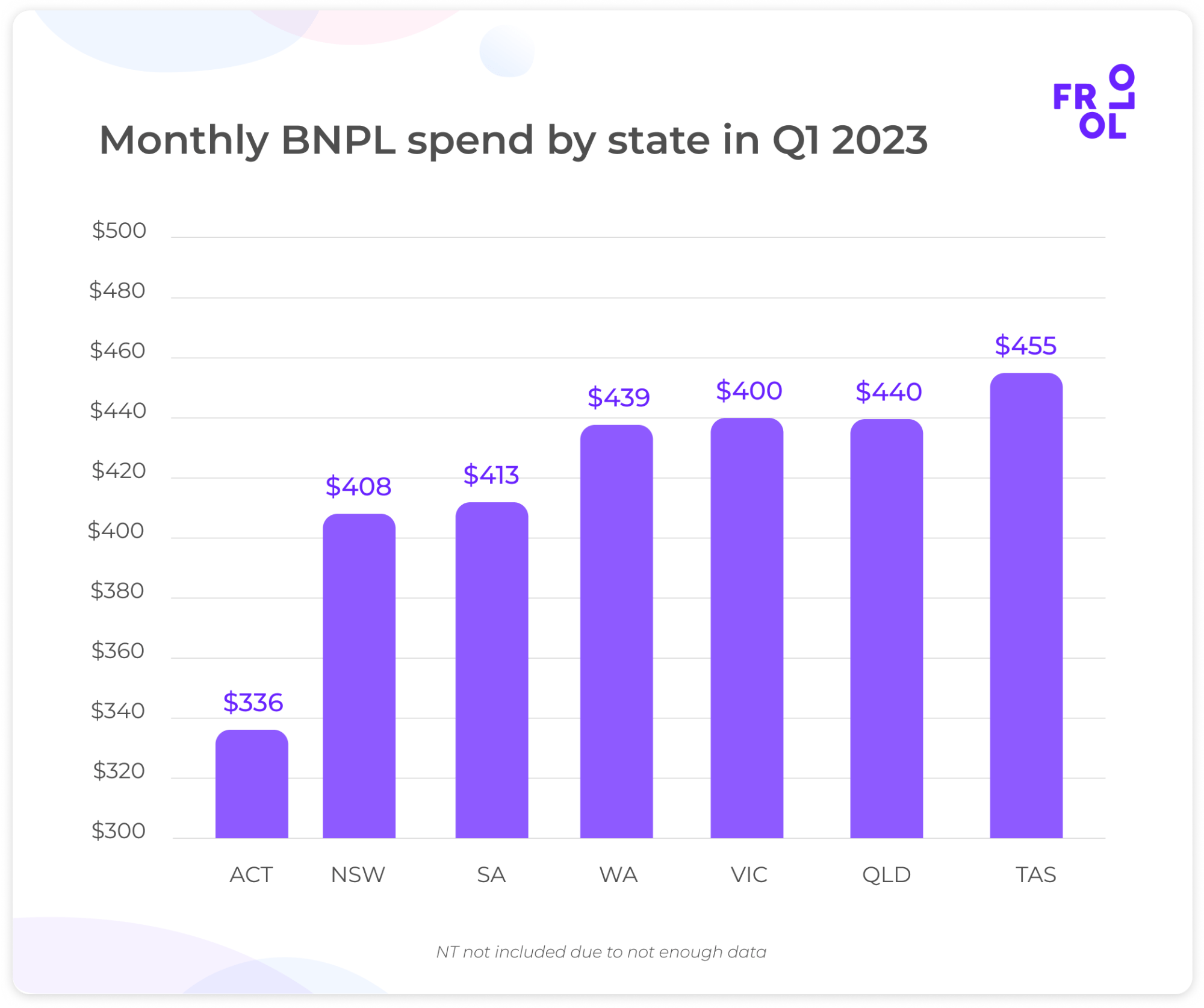

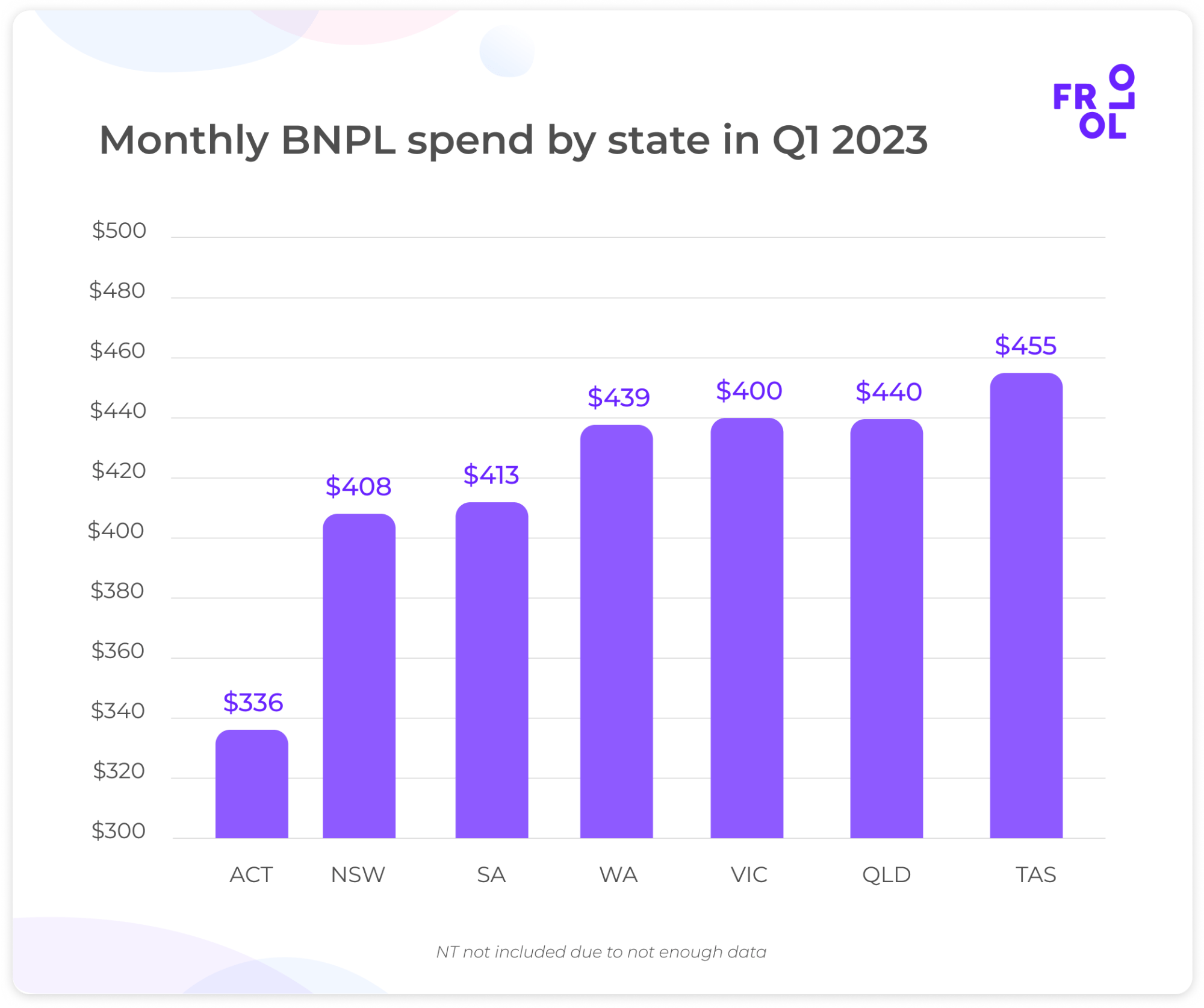

With an average monthly BNPL spend of $420 per user, the research also found customers were more likely to use credit cards to repay the debt or lean heavily on pay advance services.

The average pay advance user now spends $749 per month on credit repayments, up 60 per cent compared to Q1 2022.

Frollo said consumers risked getting caught in “a vicious cycle of debt” with younger generations such as Gen Z especially vulnerable.

Its research found 34 per cent of Gen Zs used BNPL services and only 18 per cent used credit cards, while 70 per cent of Baby Boomers used credit cards and only 18 per cent used BNPL.

“The unregistered nature of BNPL and pay advance services carries material risks for both consumers and lenders,” Frollo said. “The lack of credit checks and reporting to credit bureaus can make it difficult for other lenders to assess a borrower's ability to repay their debts, potentially leading to lending to those who can't afford it.”

Chief commercial officer at Frollo Simon Docherty said open banking would help provide a more complete financial picture of a potential customer.

“As BNPL and pay advance services continue to gain popularity, Frollo’s research highlights the associated risks for both consumers and lenders,” he said.

“With regulation underway, leaders must employ the necessary tools and technology to accurately evaluate affordability and risk.”

“Open banking can play a crucial role in mitigating these risks by providing lenders with a complete financial picture of their potential customers.”

Josh Needs

AUTHOR

Josh Needs is a journalist at Accountants Daily and SMSF Adviser, which are the leading sources of news, strategy, and educational content for professionals in the accounting and SMSF sectors.

Josh studied journalism at the University of NSW and previously wrote news, feature articles and video reviews for Unsealed 4x4, a specialist offroad motoring website. Since joining the Momentum Media Team in 2022, Josh has written for Accountants Daily and SMSF Adviser.

You can email Josh on: This email address is being protected from spambots. You need JavaScript enabled to view it.

Login

Login