Inflation is likely to edge higher when services prices are updated for last month, NAB Group Economics says.

It said the 4.9 per cent CPI figure for the year to July – a fall from 5.4 per cent in the previous month – would also be driven up by increases in energy prices, oil and petrol.

You’re out of free articles for this month

“A larger number of services will be updated in August including postal and telecom services as well as insurance, while council/property rates which are updated annually will be updated in the September quarter,” NAB said in a recent insight piece.

“Oil prices have also rebounded to high levels recently and petrol prices will push up the August CPI reading as a result. More broadly, the impact of higher energy costs continues to flow through the economy and present some risk of second-round effects of passthrough to output prices.”

Minimum and award wage rises in July would also likely add pressure to the cost side for the September quarter.

However, the bank expected to see an ongoing moderation in inflation through 2024 as the labour market softened and consumer demand growth slowed.

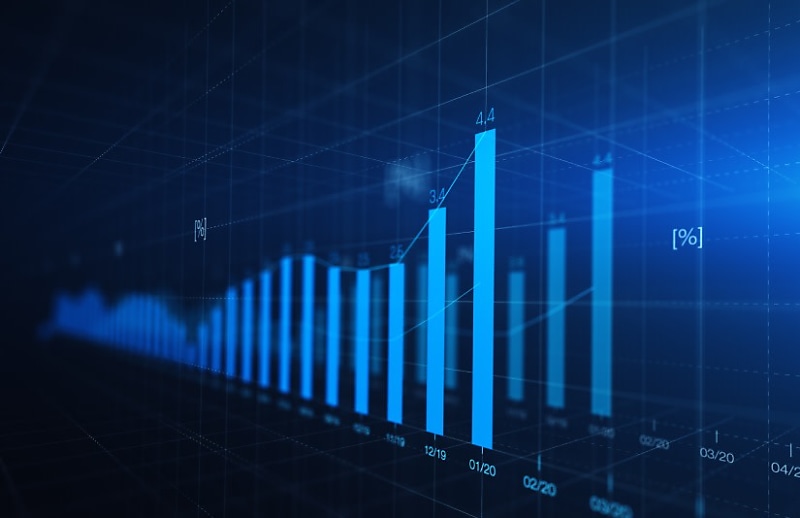

NAB expects inflation will fall to around 4.4 per cent by the end of this year and 3.1 per cent by the end of 2024.

The risks from service inflation meant the bank was predicting one further hike by the RBA this year, most likely in November.

“The recent run of activity data suggests there may be some downside risk to this, but the resilience in the labour market and potential for ‘sticky’ services still present an upside risk,” it said.

The RBA retained its hawkish bias in the minutes of its monetary policy meeting for September, saying a more restrictive policy might be required depending on the balance of risks.

The board said that inflation was still too high and was expected to remain that way for an extended period.

The RBA said that if productivity growth did not pick up as anticipated or if high services price inflation was more persistent than expected, then inflation might stay above the RBA’s target for an extended period.

“Members observed that, were inflation to remain above target for an even longer period, this could cause inflation expectations to move higher, which would be likely to require an even larger increase in interest rates in the future,” the board said in its minutes.

“Such an outcome would be costly for the economy.”

The RBA said that some further tightening in policy might be required should inflation prove to be more persistent than expected.

Login

Login