In the dynamic landscape of consulting, where fluctuating demand can lead to periods of excess capacity, SMEs have a unique opportunity. Rather than taking longer lunches and playing Sudoku, staff can spend time on R&D projects.

R&D is expensive and usually a business that focuses on R&D does so at the expense of revenue-generating activities in the here and now. Having consulting services that effectively pay for the business’s R&D activities is a great way to fund an innovation program.

You’re out of free articles for this month

Here are some of the trends I have observed and tips for consulting practices to make the most of R&D projects. In working with businesses that have redirected consultants to R&D projects, I have picked up on three main benefits.

- Innovation unlocks new opportunities

Channelling underutilised hours into R&D is an investment in the creation and exploration of new ideas. Think of it as a start-up incubator within a company, where products are developed that could eventually spin off into standalone entities. This proactive, curious approach not only positions a business at the forefront of trends and changes in its market but also diversifies the revenue streams. Imagine equipping your business with a portfolio of intellectual properties or groundbreaking solutions, ready to be pitched to both existing and potential clients.

- Tax incentives for R&D offset the operating costs

SMEs with an annual turnover of less than $20 million can access tax incentives when they engage in R&D activities.

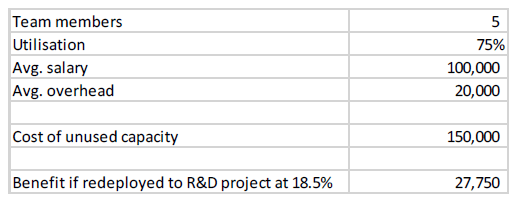

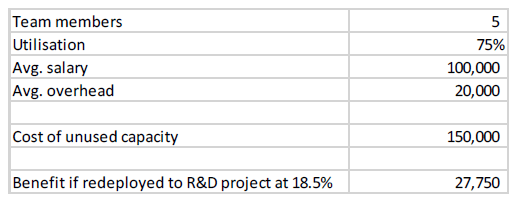

Here is a typical scenario: a company has a team of five consultants with an average salary of $100,000, predominantly working at 75 per cent capacity on client projects. There is also an overhead of $20,000 per employee for rent, insurance, software, etc.

Redirecting this team’s excess capacity to R&D could lead to an 18.5 per cent tax offset, equating to a saving of $27,750. What’s more, loss-making companies could recoup up to 43.5 per cent. The unused capacity is still a cost to the business, but tax incentives are used to lessen the cost.

- Innovation creates culture and engages employees

Investing in R&D is more than a financial play – it's a cultural one. Business leaders tell me that their employees become more engaged when they are allowed to explore new ideas, develop their skills and follow their curiosity. A team involved with innovative projects nurtures a culture of creativity and continuous learning. This not only helps retain top talent but also attracts forward-thinking individuals who are eager to work in an environment where their skills are used to drive meaningful progress.

Consulting fields where this can be applied

There are few restrictions on the fields or industry verticals where this applies. Accountants can focus on building new tech, as can marketers and designers. Xero and Canva were once just ideas.

The fields where I have observed this practice used effectively are:

- Technology and software development

- Engineering and industrial design

- Life sciences and healthcare

- Asset management

- Agricultural consulting

- Environment and sustainability

- Architecture

- Data science and advanced analytics

- Energy

- Management consulting (technical divisions)

- Telecommunications

- Cyber security

Activities that might qualify for tax incentives

If you’re looking at the tax offsets to lower costs, consider these activities:

- Conducting comprehensive IP and competitor research to establish a baseline state of knowledge.

- Developing and prototyping innovative products.

- Data analytics for predictive insights.

- Applying machine learning and AI to a problem in your field.

- Carrying out experiments to test theories and models.

- Crafting advanced software solutions.

A few tips

To make the most of generous tax incentives, consider these pointers before implementing this strategy:

- Structure your R&D within a company, as trusts and other entities are not typically eligible for these incentives.

- Understand that both core R&D activities and their direct supporting R&D activities are covered.

- Record-keeping is essential. If R&D activities take place in a forest and no one documents it, I can confirm that it did not take place.

- If your R&D initiative gains traction, remember that Early Stage Innovation Company incentives can sweeten the deal for investors.

- Keep in mind that tax incentives favour scientific and technological endeavours, and not all types of research qualify.

- The incentives are designed to bolster activities within Australia. Remote team members working abroad won’t be covered.

Tom Moore is associate director, R&D and government incentives at BlueRock.

Login

Login