The Tax Office has been dredging up old company debts to issue 26,702 director penalty notices worth $4.4 billion last year in a drastic ramp up of recovery efforts, latest figures reveal.

It is a 50 per cent jump from the 2022-23 income year which insolvency practitioners attribute to the use of “lockdown” DPNs that allow the ATO to collect from taxpayers including ex-directors of defunct companies years down the line.

You’re out of free articles for this month

Jirsch Sutherland partner Stewart Free said lockdown DPNs, once a rare occurrence, had been dominating his work post-COVID.

“We’re seeing a lot of older matters or matters which had been finalised from a formal insolvency process, basically arising from the ashes on a DPN issue,” he said.

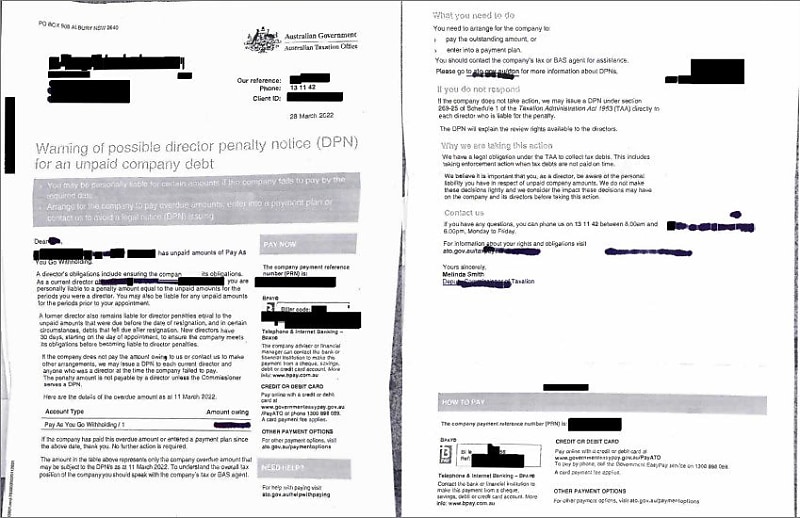

Standard DPNs give directors 21 days to repay the outstanding sum or enter administration, liquidation or small business restructuring.

But the lockdown variant is issued when companies fail to meet tax debts within three months and cannot be remitted even after winding-up proceedings.

Free said it was a “big weapon” in the ATO’s arsenal to claw back its $50 billion book of collectable debt.

“This is the first time that the ATO has started to push the issue of the lockdown DPN and they’re really flexing its muscle in relation to that,” he said.

“We're seeing a 70-30 split between lockdown and standard DPNs, previously it was at 20-80. We just expected to increase and increase.”

“Debt blew out during COVID, and it's now time to pay the piper.”

Hall & Wilcox restructuring partner Scott Butler said the crackdown primarily involved old superannuation guarantee charge (SGC) amounts, which companies incur if they fail to pay employee entitlements 28 days after each quarter.

The outstanding sums were “locked down” if an SGC statement was not lodged by the due date as they were not subject to the three-month disclosure period that applied for other tax debts.

“Most companies don't understand they need to lodge an SGC statement within one month, so that period comes around pretty quickly and then suddenly it's locked down," he said.

And instead of the ATO notifying directors as soon as they incurred a DPN, Butler said it was waiting “years and years”, leaving recipients with limited options.

“When a director has been through the winding up process, and they come out the other side, they're generally at a point in their life where they're just getting back on their feet. And guess what happens? They get hit with a big penalty notice from years ago.”

“We've got clients who have received the DPNs for amounts going back up to about eight years ago. Some have debts in the tens of thousands, but some clients, it's millions of dollars.”

“I think from a policy perspective, the ATO should be letting these directors know as soon as they've got a penalty so they can try and do something about it.”

In a statement to Accountants Daily, the ATO said the elevated levels of DPNs were a result of its return to “normal operations” and followed 17,459 DPNs issued for $2.87 billion in debts in FY2022-23.

“Over the last few years there has been an increase in collectable tax and super debt,” a spokesperson said.

“The ATO is returning to normal operations after pausing firmer actions through COVID. Accordingly, we are seeing higher numbers of DPNs issued.”

Login

Login