Tax

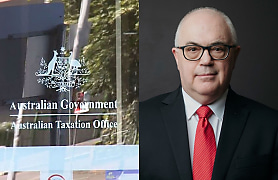

ATO’s debt book climbs to $105bn

The Commissioner has said the ATO will take deliberate and targeted action in its tax collection activities with total...

13 May 2025 • By Miranda Brownlee

Appointments

Grant Thornton Adelaide adds corporate tax partner to network

13 May 2025 • By Imogen Wilson

Tax

Tribunal rules in favour of taxpayer in tax evasion case

13 May 2025 • By Miranda Brownlee

more from tag

Business

SME owners urged to tackle succession planning roadblocks: NAB

SME owners are becoming increasingly worried their retirement will trigger the liquidation of their business,...

13 May 2025 • By Imogen Wilson

Super

Government advised to delay payday super to avoid ‘chaotic’ transition

Industry associations have raised concerns about certain design aspects of the new payday super regime and urged the...

10 May 2025 • By Miranda Brownlee

Appointments

Modoras welcomes Timothy Dalton as tax leader

The financial services firm has added a new tax leader and partner to its ranks.

12 May 2025 • By Imogen Wilson

Tax

Court strips gold bullion fraudsters of $8.7m for GST scheme

Two leaders in an Australian criminal syndicate have been stripped of more than $8.7 million in assets for their roles...

12 May 2025 • By Imogen Wilson

Tax

Corporate leader hopeful Greens will see the light on taxing unrealised...

Geoff Wilson has said he is confident the Greens will understand the impact taxing unrealised gains would have on...

12 May 2025 • By Keeli Cambourne

Tax

ATO ‘hypervigilant’ with oversight of AI activities, Hirschhorn assures...

The Tax Office is becoming increasingly data-driven, but has implemented safeguards and procedures to prevent...

09 May 2025 • By Emma Partis

Appointments

William Buck marks Aussie first with chief economist appointment

The accounting and advisory firm has welcomed the appointment of its new chief economist, Besa Deda.

09 May 2025 • By Imogen Wilson

Super

SMSFA still hopeful Div 296 bill may include amendments

There is still hope that the Division 296 is not a “done deal”, the head of the SMSF Association has said.

08 May 2025 • By Miranda Brownlee

Business

CPA and ACS enhance IT and accounting prospects with MoU

The professional accounting body has joined forces with the Australian Computer Society to collaboratively support the...

09 May 2025 • By Imogen Wilson

Business

Hold off on major changes until final Div 296 bill is passed, experts warn

“Don’t pull the trigger just yet” is the overwhelming advice coming from the SMSF sector regarding preparing for the...

07 May 2025 • By Miranda Brownlee

Business

Public executive accused of splashing out millions contracting friends: ICAC

A former executive of School Infrastructure NSW (SINSW) has been accused of spending millions of taxpayer dollars on...

08 May 2025 • By Emma Partis

Business

Accounting shortage opens up ‘dream job’ opportunities for accountants

The accountant shortage has given workers more bargaining power to secure better conditions, public accountant...

08 May 2025 • By Emma Partis

Tax

Air fryer fails tax deduction ‘pub test’: ATO

The Tax Office has revealed a list of “unbelievable” tax deduction attempts to remind taxpayers that their air fryer...

08 May 2025 • By Imogen Wilson

Business

CPA applauds Qld government for bolstering SME community

The Queensland government’s Small and Family Business First Action Statement has been welcomed with open arms by CPA...

07 May 2025 • By Imogen Wilson

Tax

$1k standard deduction to free up ATO’s resources, says H&R Block

Labor’s proposed $1,000 standard deduction looks set to proceed following the party's win in the federal election.

07 May 2025 • By Miranda Brownlee

Tax

Merchant decision fortifies ATO’s position on Part IVA, accountants warned

The Full Federal Court decision demonstrates the full reach of Part IVA and has important implications for SME...

07 May 2025 • By Miranda Brownlee

Tax

Accounting bodies push for Div 7A ‘legislative fix’

Members of the professional accounting bodies are calling for reform to Division 7A as the Tax Office pushes its...

07 May 2025 • By Imogen Wilson