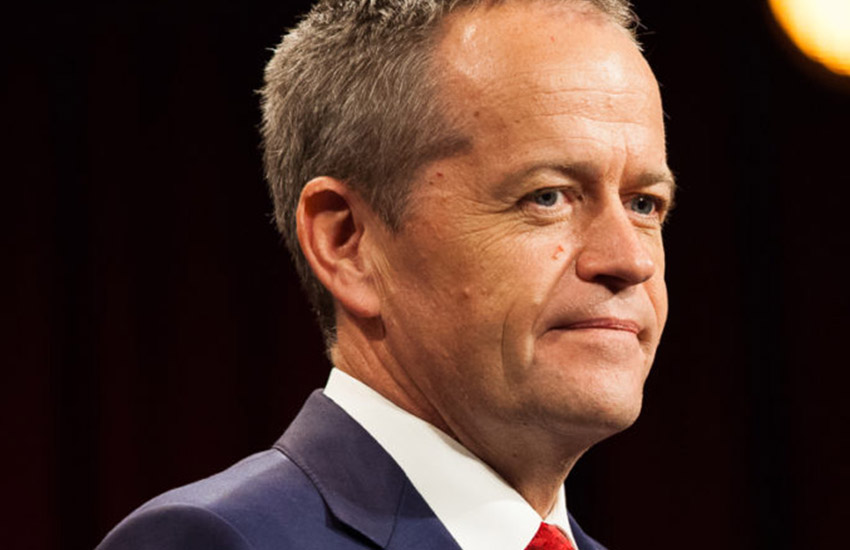

Opposition Leader Bill Shorten’s plan to restore weekend and public holiday penalty rates and to allow casuals a pathway to permanent employment has been met with scepticism from the bookkeeping industry.

26 June 2025

New Broker Academy 2025

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MORE

Login

Login