Accounting software outfit ChangeGPS is sounding the alarm about a revision to the CA ANZ conduct code that could expose firms to “financial penalties from disgruntled client claims”.

The change, one of nine resolutions being put to a member vote, would allow CA ANZ’s Professional Conduct Committee “to demand a refund or credit for fees if they rule you to have breached your ethical standards”, says an email flagging today’s Change GPS webinar on the topic.

You’re out of free articles for this month

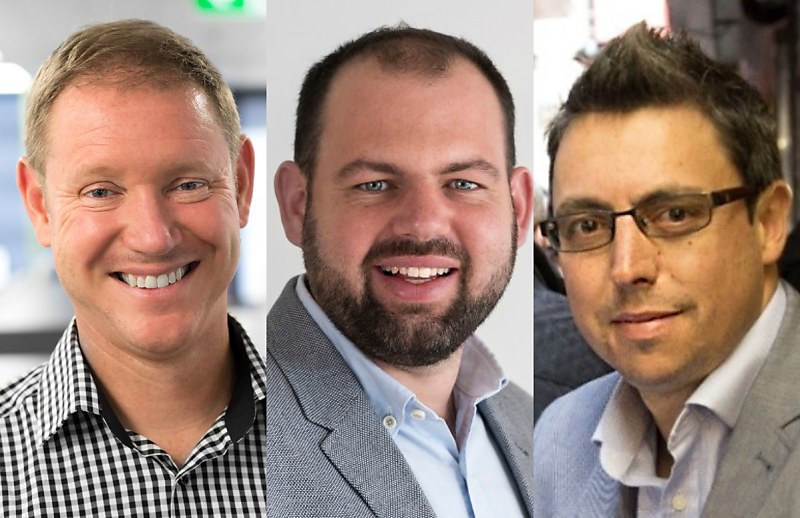

The 1pm event, headlined ‘CA ANZ could enforce you to refund clients’, is being hosted by Change GPS founder Tim Munro, CEO David Boyar and Paul Meissner, chief compliance officer at 5Ways Group.

Mr Meissner said he was concerned there could be unintended consequences of Resolution 6, such as “clients of small firms smelling the ability to call anything an ethical breach and trying to get fees back when they’re otherwise not happy”.

He said CA ANZ was “not in a position to be able to understand the contractual obligations of a client and their accountant” and assurances that the resolution would apply only to the most egregious circumstances that lacked safeguards.

“If the disciplinary panel decided that it should go further, they can tell the member that they want the fees to be refunded,” he said. “There’s no linking it to an ethical breach, there’s no criteria for how it will be decided.”

“You go through disciplinary and you’re not allowed to ever talk about it publicly. So they’re judge, jury and executioner.”

“They decide which cases are ethical and which aren’t, and then they decide how much money each member has to pay for the privilege of being disciplined.”

CA ANZ opened member voting on changes to its bylaws two weeks ago and the period ends on 20 October at the close of its AGM. The resolutions stem from a review of conduct procedures in the wake of the KPMG exam cheating scandal and also include increased fines and a stronger response to “firm events” following the PwC tax secrets affair.

Resolution 6 said:

“New sanction (bylaws only): The changes seek to align the bylaws with the NZICA rules by enabling the Professional Conduct Committee to propose, and the disciplinary tribunal to impose, orders that the member be required to refund fees paid by a complainant or to waive fees owed by a complainant.”

CA ANZ said pulling Australian and New Zealand rules into alignment was a key objective of the review and the bylaws allowed the PCC to dismiss complaints “without investigation which it considers are trivial, frivolous, vexatious or made in bad faith”.

It said in most cases, fee disputes were more appropriately dealt with by the courts or civil tribunals, and there would be no investigation unless there had been a breach of ethical requirements.

Its power to order refunds or waivers in New Zealand had been used in “narrow circumstances”.

“In practice, this has been triggered by, for example, retaliatory billing/billing for work not performed at all or outside the scope of the agreed engagement/grossly disproportionate fees.”

“The normal rights of a member to seek a review of the PCC’s decision apply here also.”

The email flagging today’s Change GPS webinar said: “How would you feel about your professional body deeming that you’ve missed something and forcing you to repay thousands of dollars back to a disgruntled client – and if you don’t, you forfeit your membership!”

Mr Boyar said the webinar had been pulled together quickly to alert practitioners to Resolution 6.

“I don’t think that the average small-medium practitioner wants to be expanding CA’s penalties for ethical breaches at the moment, because they feel like not enough penalties have been applied to literally the most egregious of breaches,” he said, referring to the examples of PwC and KPMG.

He welcomed CA ANZ’s move to tighten its conduct code but said the body failed to recognise the impact of Resolution 6 on small-medium practices, many of whom had “war stories of unfair treatment” by the conduct process.

“These things are big deals for small practices, where they don’t get diverted to some risk and governance team – it’s the partner dealing with it. If something like this happens, this takes over their life.”

He said the webinar aimed to create awareness about the ramifications of this rule change and would offer practical help to firms in mitigating risk.

Mr Meissner said Resolution 6 should be voted down.

“These rules don’t revamp anything to do with the process and the process is not transparent,” he said.

“Are they allowed to tell people to give back their salary? There just seems to be no protections. It could go pear-shaped pretty quickly.”

Login

Login