ASIC has moved to disqualify Philip Shugg of Victoria from being an SMSF auditor for not being a fit and proper person as he was bankrupt.

Greg Marlow of the Northern Territory has been suspended for one year and had a condition imposed on his registration for significant deficiencies in auditing the ownership and valuation of fund assets, lease agreements, whether transactions were on an arm’s-length basis, and compliance with personal use and collectable asset rules.

You’re out of free articles for this month

ASIC also contends that he issued an audit report in an incorrect form, and did not obtain signed financial statements.

The corporate regulator has also moved to impose conditions on four SMSF auditors.

John Redenbach of New South Wales has had conditions imposed for deficiencies in maintaining auditor independence, and deficiencies in audit work on the ownership and valuation of fund assets and whether a transaction was on an arm’s-length basis.

ASIC has moved to impose conditions on Lenneke Serjeant of New South Wales for deficiencies in maintaining auditor independence, and deficiencies in audit work on the valuation of fund assets, lease and loan agreements, execution of trust deeds and reviewing the investment strategy by trustees.

The corporate regulator has also imposed conditions on Angelo Covelli of Victoria for deficiencies in audit work on the valuation of fund assets, limited recourse borrowing arrangements, lease agreements and rental statements.

Lastly, Darren Tappouras of New South Wales will face conditions because of deficiencies in audit work on the ownership and valuation of fund assets, in-house asset requirements and limited recourse borrowing arrangements. He also did not obtain signed financial statements and did not comply with CPD requirements.

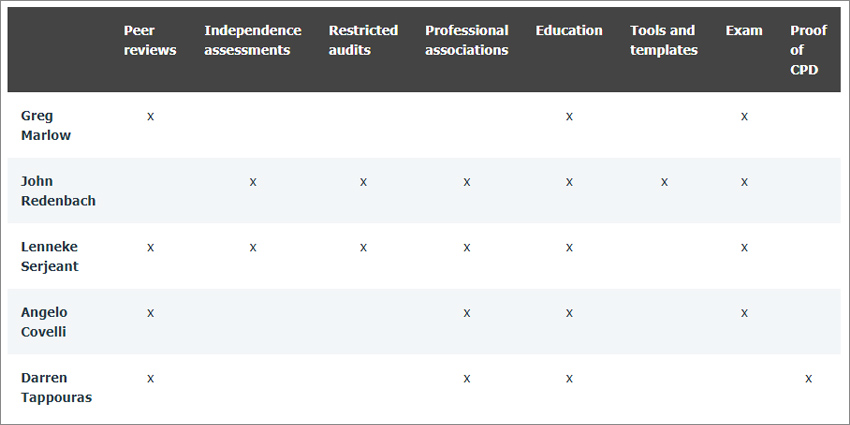

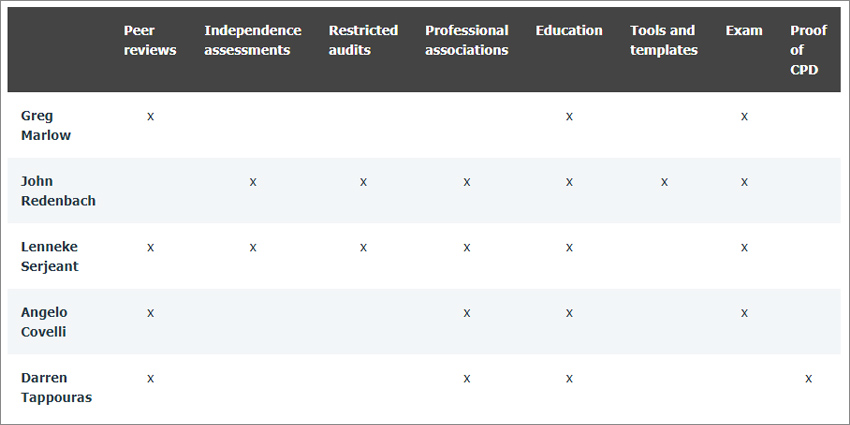

The various conditions imposed across the auditors include:

- Peer reviews – Having a number of audits reviewed by an independent SMSF auditor for compliance with auditing standards.

- Independence assessments – Performing and reporting on specific independence threat assessments for all clients.

- Restricted audits – Being restricted from conducting any audits in independence threat situations regardless of any safeguards.

- Professional associations – Providing a copy of the conditions to their professional association.

- Education – Completing specific courses of study, including in ethics and audit.

- Tools and templates – Reviewing tools and templates to ensure they are up to date and complete.

- Exam – Sitting and passing the SMSF auditor competency exam.

- Proof of CPD – Providing proof of compliance with CPD requirements annually for three years.

Jotham Lian

AUTHOR

Jotham Lian is the editor of Accountants Daily, the leading source of breaking news, analysis and insight for Australian accounting professionals.

Before joining the team in 2017, Jotham wrote for a range of national mastheads including the Sydney Morning Herald, and Channel NewsAsia.

You can email Jotham at: This email address is being protected from spambots. You need JavaScript enabled to view it.

Login

Login