How CAs learn not to talk about tax during Tax Time 2018

TaxIt’s almost Tax Time 2018 and the ATO’s communications team is sparing no effort in helping taxpayers understand the dos and don’ts of personal tax return preparation. I’ve lost count of the media already generated, and we haven’t even got to 30 June yet.

Tax agents are also being targeted as part of an ATO strategy to address growing levels of work-related deductions.

At a big picture level, the ATO’s efforts should be appreciated.

Taxpayers will hopefully be more aware of their entitlements and less inclined to guild the lily. And although some tax agents are concerned about the ATO’s heightened scrutiny of our profession, Form I preparers rarely acknowledge the benefit of all this government-funded publicity and the subliminal message that tax is complex, so better see a specialist.

Given this background, what I’m about to say may come as a surprise to those who think tax returns are mainly a compliance exercise — putting correct information and numbers in a form.

In my 35 years working in tax, the best personal tax advisers I’ve worked with don’t talk much about tax when they meet clients.

It’s a trait I particularly associate with the many CAs I’ve met during my career. Their general tax, financial knowledge and client experience combine in what I call “practical wisdom”. They communicate not by interrogating clients about car log books, travel diaries and receipts, but by taking a lifelong personal interest in their clients’ success — a goal that isn’t defined simply by reference to wealth creation.

Most young CAs in public practice hopefully get to see this when they tag along to client meetings with an experienced colleague. Older CAs know these “watch, listen and learn” opportunities are the best form of personal and professional development.

So sitting here writing this, it’s hard to convey what I mean in a few hundred words.

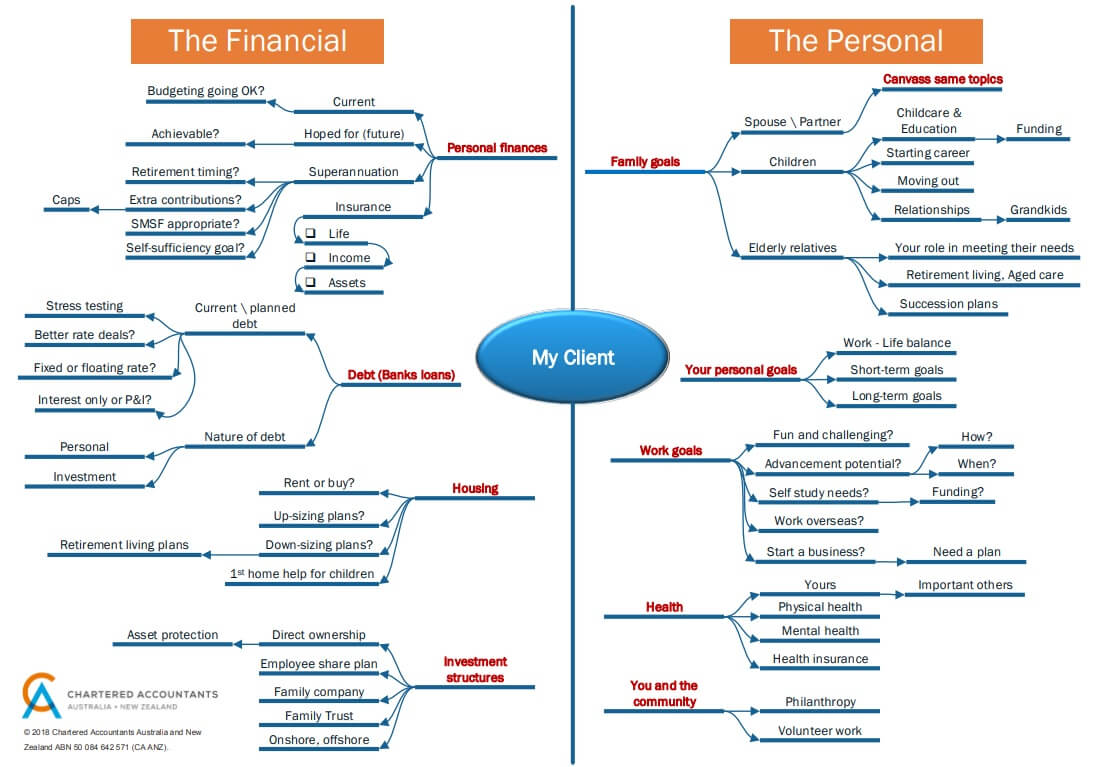

My small contribution here is to use my limited Visio skills and create a diagram (below) which seeks to capture the main non-tax, personal topics which experienced CAs might canvass when they meet individual clients. [By the way, I stress meet — skip the telephone and try never to engage in a personal dialogue via email.]

Not all my topic headings will be relevant, and please don’t use the diagram as a Q&A prompt.

Rather, ask your client open questions around the general topic areas, get the client talking about what’s important to them, and LISTEN. Don’t jump in and show how clever you are. Don’t judge. Look for clues on what matters most to the client. Reflect on what you (or other professionals) can do to help. Proffer ideas or alternatives, rather than dictating solutions. Not knowing the definitive answer at a meeting is OK, as long as you follow-up quickly with the advice promised.

Nobody is a miracle worker. Sometimes, a client appreciates just having someone they trust to talk to.

Oh yes, and make sure you get the personal tax compliance work right too. Personal clients trust you to maintain their standing in the eyes of the ATO.

And for any CAs reading this who don’t work with private clients in a day-to-day sense, think about how you too can develop key personal, professional relationships. After all, people run companies, trusts and partnerships: ultimately, people are shareholders, beneficiaries and partners. Value the work of your private client colleagues. There is a close correlation between good personal tax service and follow-up requests for business tax and other advisory services.

Michael Croker, tax leader, Chartered Accountants Australia and New Zealand