26 June 2025

New Broker Academy 2025

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MORE

Treasury Laws Amendment (2019 Measures No. 3) Bill 2019 was passed by the Senate on Friday, bringing consistency across the FBT Act and the GST Act by amending the definition of a taxi to “a motor vehicle used for taxi travel (other than a limousine)”, replacing the current definition of a taxi as “a motor vehicle licensed to operate as a taxi”.

However, the House of Representatives disagreed with an unrelated amendment put forward by Centre Alliance senator Rex Patrick to bring grandfathered large proprietary companies into ASIC’s reporting requirements.

As such, the bill will return to the Senate for consideration, meaning the FBT exemption for licensed taxis will not extend to ride-sharing providers such as Uber.

The ATO confirmed that view in July last year, putting it at odds with the definition of a taxi in the GST Act.

Since a Federal Court decision in 2017, ride-sharing providers such as Uber have been required to be registered for GST on the basis that they were supplying taxi travel.

The proposed bill recognised the influx of ride-sharing providers and noted the contentious and difficult nature of administering the current definition of a taxi in the FBT Act, hence proposing the amendment which would have brought both definitions in line with each other to treat Uber vehicles the same as taxis.

Delay to FASEA extension

The back-and-forth between houses has also caused a delay to a measure in the bill that would have extended the requirement for financial advisers to complete the FASEA exam by one year to 1 January 2022.

The transitional time frame for financial advisers to obtain the approved degree or equivalent qualification would have also been deferred by two years to 1 January 2026.

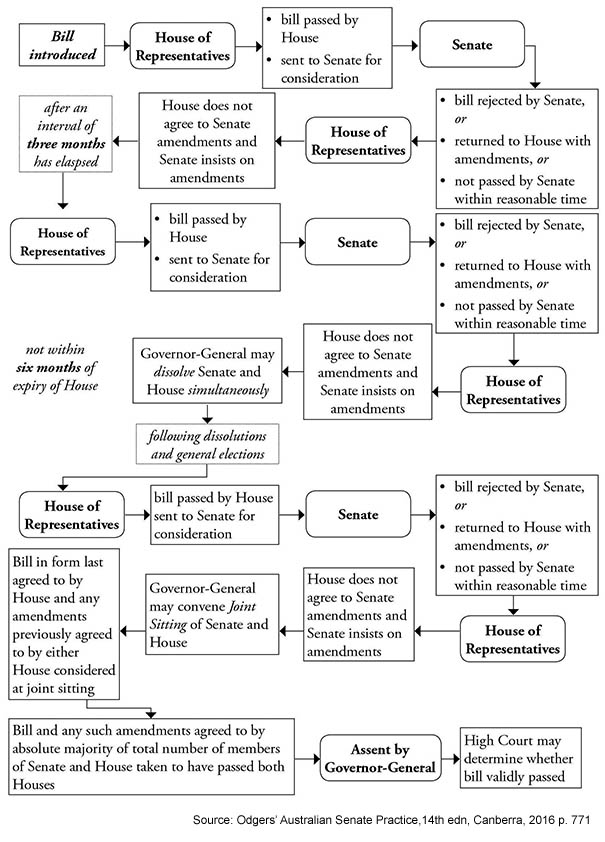

Senator Patrick has confirmed he will insist on his amendment, casting doubt on the future of the bill and whether it will trigger section 57 of the constitution to resolve the deadlock.

Section 57 provides that if the Senate twice insists on amendments, the Governor-General may simultaneously dissolve both houses. If, after the dissolution, the dispute continues, the Governor-General may convene a joint sitting of the two houses.

AUTHOR

Jotham Lian is the editor of Accountants Daily, the leading source of breaking news, analysis and insight for Australian accounting professionals.

Before joining the team in 2017, Jotham wrote for a range of national mastheads including the Sydney Morning Herald, and Channel NewsAsia.

You can email Jotham at:

Comments will undergo moderation before they get published.

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login