Promoted by Accountancy Insurance

![]()

Be in the know with the latest tax audit claim stats and how JobKeeper attracts audit activity.

Promoted by Accountancy Insurance

![]()

Be in the know with the latest tax audit claim stats and how JobKeeper attracts audit activity.

Every accountant will know that reviews or audits of your client’s tax returns can sometimes be unavoidable. This is seldom a reflection of the work that is put into preparing the returns and is more often than not due to a specific crackdown by the Australian Taxation Office (ATO) or other State government revenue authorities. It could be through a variety of data matching or artificial intelligence sources used to assist in initiating audit activity of your client’s lodged returns. These methodologies have been proven time and time again to work very well – which is why the ATO and other government revenue authorities keep receiving increased funding and resources to continually improve and streamline their audit activity targeting processes.

We are now well and truly into a new financial year and just like in previous years the Accountancy Insurance Claims team have identified some noteworthy claim statistics over the past 12 months that may be of interest to your accounting firm.

Read on to see what statistics and insights the Accountancy Insurance Claims team has collected from the 2019-2020 financial year.

Number One: Employer Obligations Audits and Reviews (PAYG/SG/FBT)

The Accountancy Insurance Claims team noted a similar frequency in Employer Obligations Audits and Reviews (by claim type) over the past two years. This however continues to be our most frequent claim type. For accountants this may be the most frustrating type of audit activity as it is one where accountants are not always in control. In general accountants don’t get involved in their client’s payroll preparation or maybe see it once a year (when it’s too late) at tax return preparation time.

Some of the other factors that contribute to this claim type being the most common in our experience has been the timelier data capturing by the ATO using Single Touch Payroll (STP) and disgruntled employees “dobbing in” their employer to the ATO.

Claim proportion (frequency) 2019-2020: Employer Obligations Audits and Reviews (PAYG/SG/FBT) accounted for 19.36% of all Accountancy Insurance claims.

Number Two: BAS Audits and Reviews (Pre & Post Assessment)

BAS Audits and Reviews have remained steady since 2018 with only a very small increase noted in 2019-2020. Although this may seem insignificant, it reinforces the focus of the ATO on these types of audits and reviews. In this case the ATO tends to focus on large refunds, property sales and acquisitions, margin scheme, and data mismatching between BAS v Income Tax Returns disclosures.

Claim proportion (frequency) 2019-2020: BAS Audits and Reviews (Pre & Post Assessment) accounted for 12.88% of all Accountancy Insurance claims.

Number Three: Payroll Tax Investigations (All States)

Payroll Tax Investigations (All States) was the 3rd most frequent claim type and continues to be a major focus area by all State Revenue Offices around the country. Comparing the claim frequency of Payroll Tax Investigations in 2018-2019 to that in 2019-2020, we can report a small increase in this area. Issues identified in Payroll Tax investigations include:

Claim proportion (frequency) 2019-2020: Payroll Tax Investigations (All States) accounted for 12.60% of all Accountancy Insurance claims.

Number Four: Income Tax Audits and Reviews

Following closely behind Payroll Tax in claim frequency is Income Tax which can cover a vast array of different types of ATO audit activity that can be linked back to the lodged income tax returns of taxpayers. Comparing the claim frequency of Income Tax Audits and Reviews in 2018-2019 to that in 2019-2020, we can report a small increase in this area.

Claim proportion (frequency) 2019-2020: Income Tax Audits and Reviews (Full/General/Combined) accounted for 10.24% of all Accountancy Insurance claims.

Earlier in this article we mentioned that often audits and reviews of your client’s tax returns or employer obligations compliance can be unavoidable. Regularly we hear from accountants that they “don’t need to worry about tax audit insurance as they always take the conservative approach when preparing their client tax returns” and as a result they are “not on the ATO audit radar”.

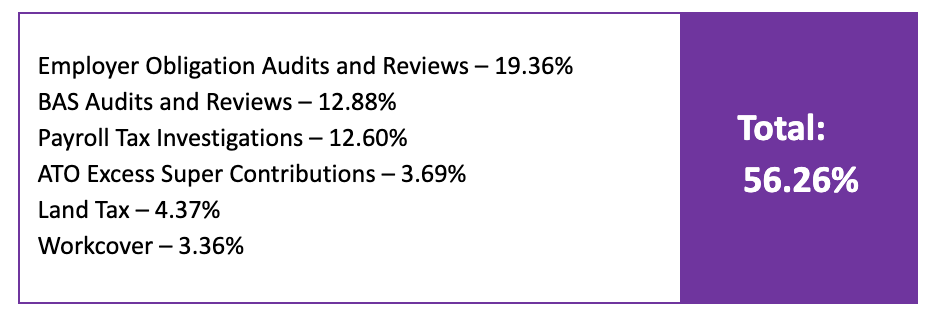

However, there are a lot of ATO and State government revenue authority audits and reviews (including the three highest claim types noted) where quite often the accountant only becomes involved after the audit activity has started. In fact, over 56% of the audit activity we saw in 2019-2020 were for claim types where the taxpayer (your client) and/or a bookkeeper may have prepared the lodged returns or managed the employer obligations compliance that were under audit and the accountant has had no involvement nor performed any checks or reviews prior to the audit activity being instigated.

Frequency for claim types 2019-2020 that accountants may never see - until it’s too late:

$1M to $3M turnoverThroughout the mix of accounting firms and their participating clients working with Accountancy Insurance (which is well over 3,000 firms), the following client categories had the highest number of claims in 2019-2020:

Another notable highlight was that the value of claims in the ‘Self Managed Superannuation Fund’ category more than doubled in 2019-2020 supporting the ATO audit focus on the SMSF space which is well documented by the ATO and in the media.

Although the number of audits and reviews of Self Managed Superannuation Funds seems small compared to other claim types, this is primarily attributed to it being a very minor subset in a larger pool of the claims listed. Unlike, for example, Employer Obligation Audits and Reviews or BAS Audits and Reviews; Self Managed Superannuation Fund Audits and Reviews focus quite specifically on one entity type with one category of tax payer. This may make the proportion of claim frequency appear to be small in comparison to all of the other claims but certainly there has been a lot of activity in the SMSF space on its own.

For a detailed breakdown of the claim frequency in Australia based on claims processed by the Accountancy Insurance Claims team click here.

With JobKeeper now in full effect it can be said with some certainty that the ATO will be watching and monitoring the scheme very closely to ensure those employers that receive the JobKeeper payments are entitled to do so which will result in increased audit activity given the payments to employers commenced in May 2020 and will now end in March 2021.

With STP, the ability for the ATO to flag over or under payments of JobKeeper payments is very high. We would expect mismatches with JobKeeper payment employee enrolments and STP to be a big driver of audit activity. This will also include mismatches that have occurred because of flaws in the algorithm of the data analysis.

Audits and reviews of the JobKeeper payment scheme are expected to continue for anywhere between the next 12 months and maybe even up to 2 years after the JobKeeper payment end date. Audits and reviews commenced in June/July 2020 with the initial ATO audit activity concentrating on:

We are pleased to announce that we have put in place an endorsement to our Audit Shield policy which includes JobKeeper payment audits and reviews.

It only covers JobKeeper payments and all reviews or audits of other Covid-19 support packages are not covered unless they form part of an audit or review of a lodged return (i.e. BAS audit, Payroll Tax audit etc.). The endorsement only covers post payment reviews or audits so any issues or queries with the JobKeeper payment application process are not covered.

Read more about this policy endorsement here or contact the team to find out more.

The ATO and other relevant government revenue authorities in Australia are not going anywhere. They will continue to find new and innovative ways to deal with those taxpayers that are intentionally or unintentionally not paying their fair share of tax – that we can be certain of. This is emphasised throughout the media and is reinforced by the continued support from the Australian Government both financially and through various data-sharing platforms.

As official reviews, audits, investigations and enquiries of taxpayer lodged returns and their taxation affairs in general continue to remain prevalent, the best course of action is to ensure that your accounting firm has a comprehensive tax audit protection solution such as Audit Shield in place.

Audit Shield ensures your professional fees will be covered in the event of ATO and other government revenue authorities’ initiated audit activity with respect to lodged client tax returns and financial compliance obligations.

It also means that you can avoid the awkward conversation concerning additional fees incurred when dealing with government revenue authority initiated audit activity with your client. It’s a win-win and no net-cost solution for your accounting firm and your clients.

To find out more about Audit Shield visit the Accountancy Insurance website or call our team on 1300 650 758.

Co-written:

Rod Spicer

Associate Director, Accountancy Insurance

Roman Kaczynski

Director, Accountancy Insurance

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login

You are not authorised to post comments.

Comments will undergo moderation before they get published.