Chapter 20 of the ATO’s Fringe benefits tax – a guide for employers has now been updated to reflect the increase of the small business entity turnover threshold from $10 million to less than $50 million per annum.

As such, from 1 April 2021, businesses with an aggregated turnover of less than $50 million will be exempt from the 47 per cent fringe benefits tax on car parking benefits provided to employees if the parking is not provided in a commercial car park.

You’re out of free articles for this month

Likewise, multiple work-related portable electronic devices provided to employees will be exempt from FBT — even if the devices have substantially identical functions.

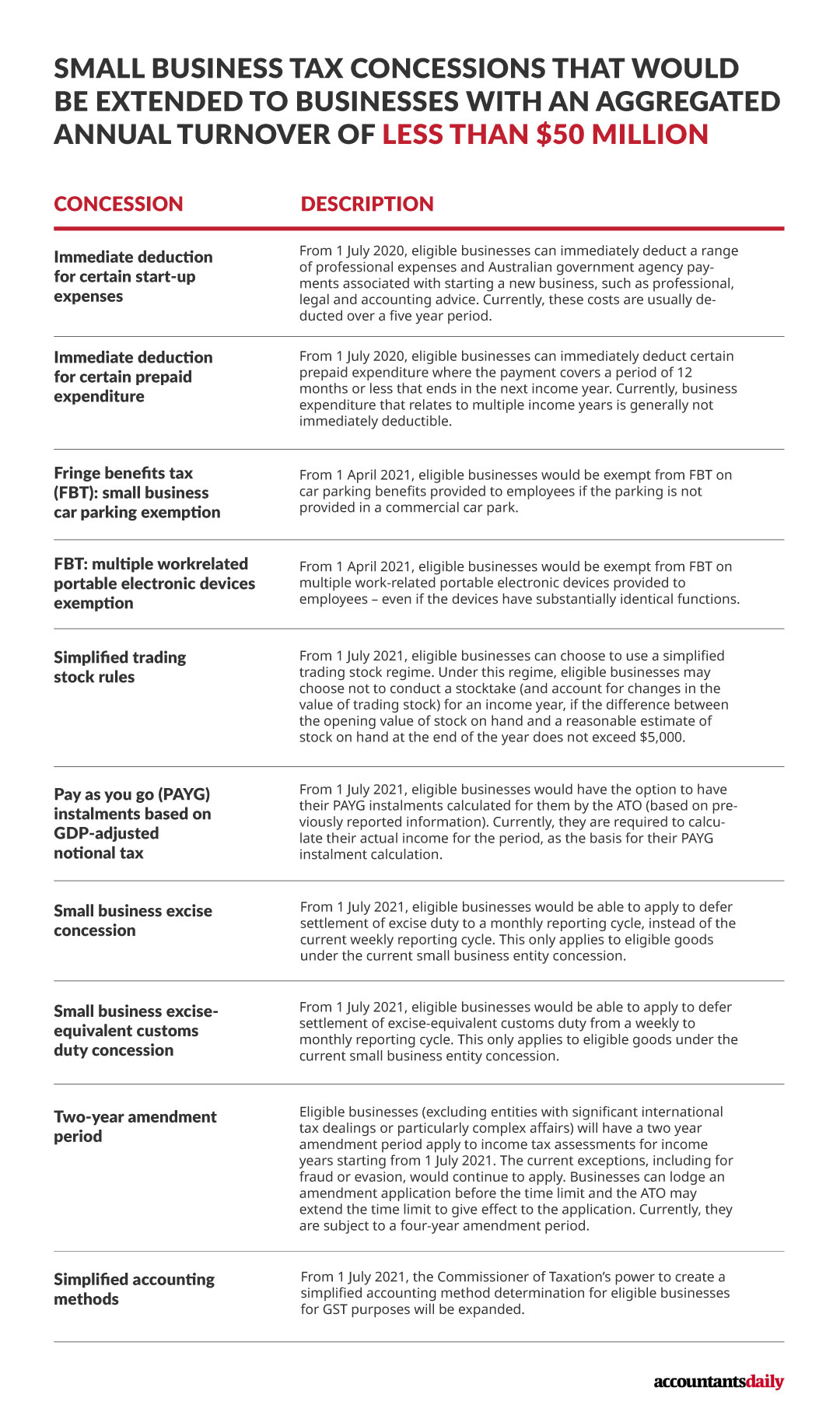

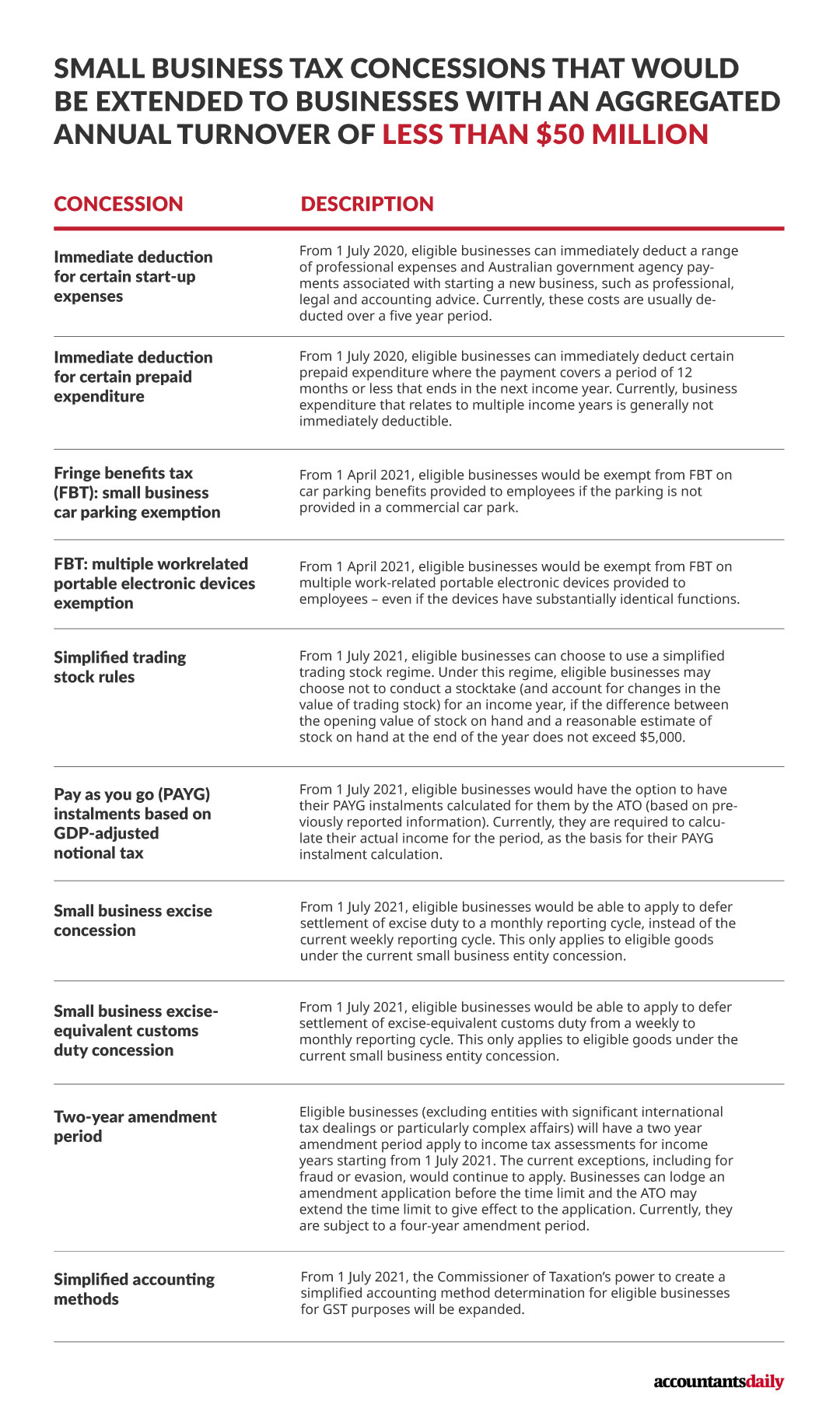

The increase to the small business entity turnover threshold to less than $50 million was announced in the October federal budget, allowing more entities to access 10 tax concessions that were previously available only to entities with a turnover of under $10 million.

From 1 July 2020, these newly eligible businesses can immediately deduct certain start-up expenses, such as professional, legal and accounting advice; and certain prepaid expenditure where the payment covers a period of 12 months or less that ends in the next income year.

From 1 July 2021, eligible businesses will be able access simplified trading stock rules, remit pay-as-you-go (PAYG) instalments based on GDP adjusted notional tax, and settle excise duty and excise-equivalent customs duty monthly on eligible goods.

Eligible businesses will also have a two-year amendment period apply to income tax assessments for income years starting from 1 July 2021, a reduction from the current four-year amendment period.

In addition, from the next financial year, the Commissioner of Taxation’s power to create a simplified accounting method determination for GST purposes will be expanded to apply to businesses below the $50 million aggregated annual turnover threshold.

Jotham Lian

AUTHOR

Jotham Lian is the editor of Accountants Daily, the leading source of breaking news, analysis and insight for Australian accounting professionals.

Before joining the team in 2017, Jotham wrote for a range of national mastheads including the Sydney Morning Herald, and Channel NewsAsia.

You can email Jotham at: This email address is being protected from spambots. You need JavaScript enabled to view it.

Login

Login