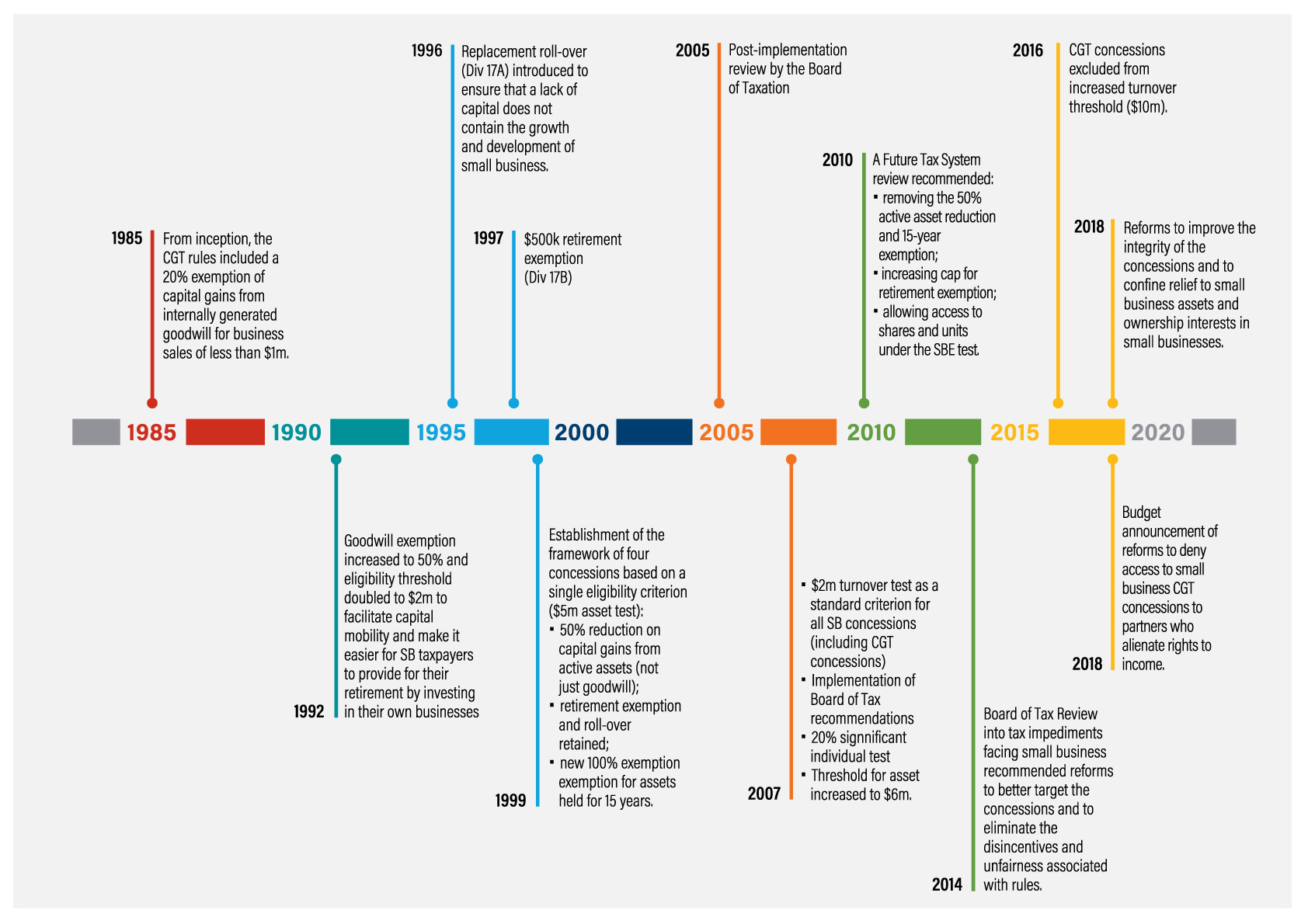

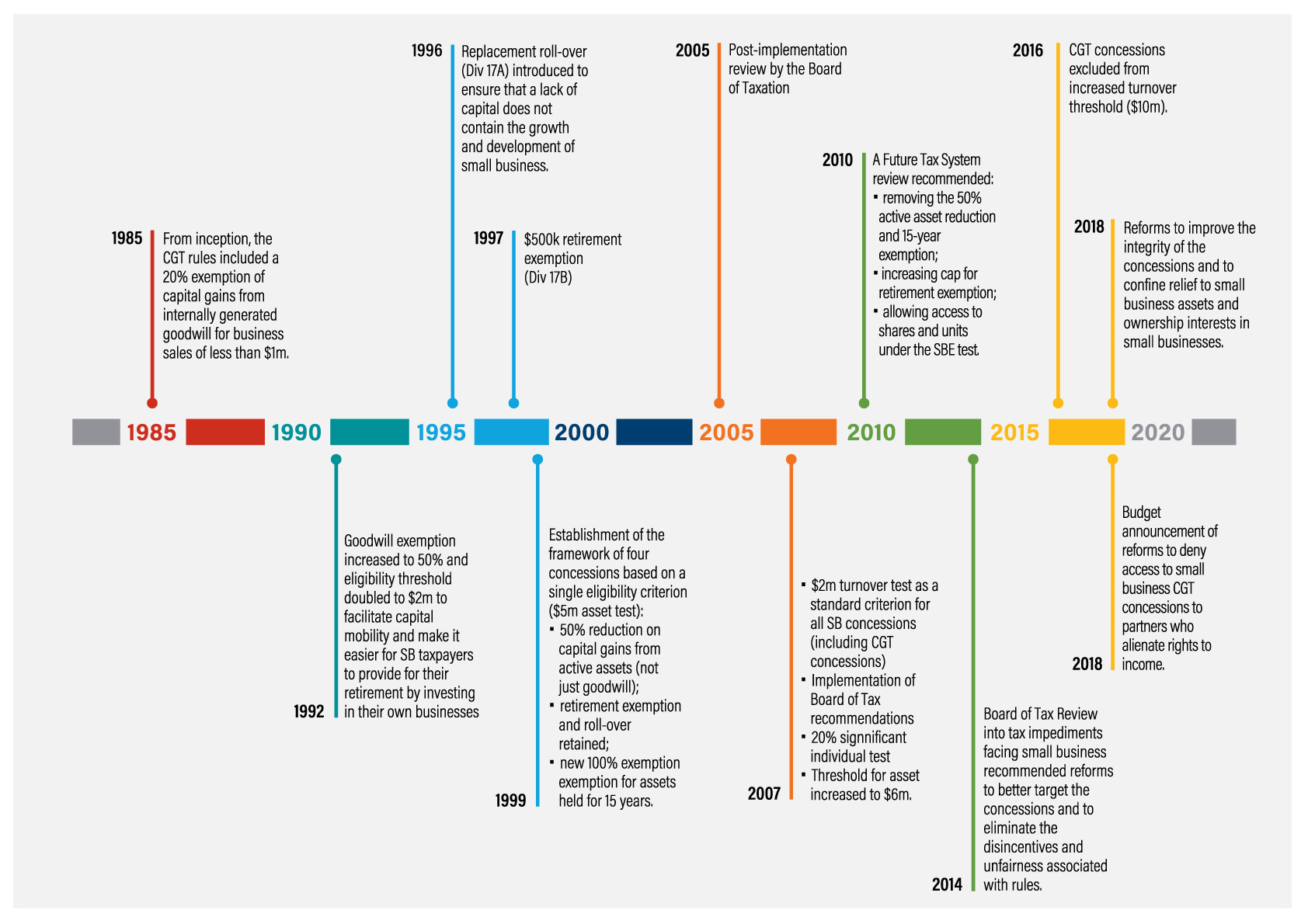

The renewed calls for reform by the Institute of Public Accountants comes after the Board of Taxation’s 2019 review of small business tax concessions found that the four CGT concessions had drifted from the original policy intent and were no longer sustainable.

Originally meant to provide security in retirement for small-business owners or encourage growth, sheltered capital gains ballooned to $6.2 billion in 2015–16, with some claims rising to $80 million per claim.

You’re out of free articles for this month

Claims above $6 million more than doubled between 2013–14 and 2015–16, with the total value of those claims rising from $180 million to $400 million.

“It is going well beyond the original policy intent in the sense that we are seeing excessively large claims effectively being tax-sheltered because there is no capping of the concessions,” the IPA’s general manager of technical policy, Tony Greco, told Accountants Daily.

“We anticipate that if this trend continues, the concession may become unsustainable in its current form. The size of these gains that receive preferential tax treatment doesn’t align with the original policy intent and the concept of fairness and equity.

“The rules have to be fit and proper to make sure we’re not sheltering gains of this magnitude.”

Mr Greco believes the government should take heed of the Board of Taxation’s recommendations, which include collapsing the 15-year exemption, active asset reduction and retirement exemption, and replacing them with one CGT exemption subject to a cap.

The board has also called for the eligibility turnover threshold to be raised from $2 million to $10 million, and to repeal the maximum net asset value test.

“For this to be economically sustainable, it will need the introduction of a cap for the first time, on the size of the benefits that will receive preferential tax treatment under these concessions to ensure a larger proportion of the benefit is not accessed by a relatively small number of businesses,” Mr Greco said.

“You’re allowing more people into the tent [by increasing the turnover threshold], but if those people are investing in a small business, then it goes back to the policy intent and you want to reward them under certain conditions for disposal of an active asset.

“This would be a good reform pathway forward to address current issues such as fairness, complexity and sustainability. There are considerable savings to be made which can be directed to other measures such as the small business tax offset.”

Jotham Lian

AUTHOR

Jotham Lian is the editor of Accountants Daily, the leading source of breaking news, analysis and insight for Australian accounting professionals.

Before joining the team in 2017, Jotham wrote for a range of national mastheads including the Sydney Morning Herald, and Channel NewsAsia.

You can email Jotham at: This email address is being protected from spambots. You need JavaScript enabled to view it.