Both measures, announced in last year’s October budget, will now be extended for 12 months until 30 June 2023 at a cost of $20.7 billion over the next four years.

The Treasury expects both measures to create around 60,000 jobs and boost GDP by $18 billion by the end of 2022–23.

You’re out of free articles for this month

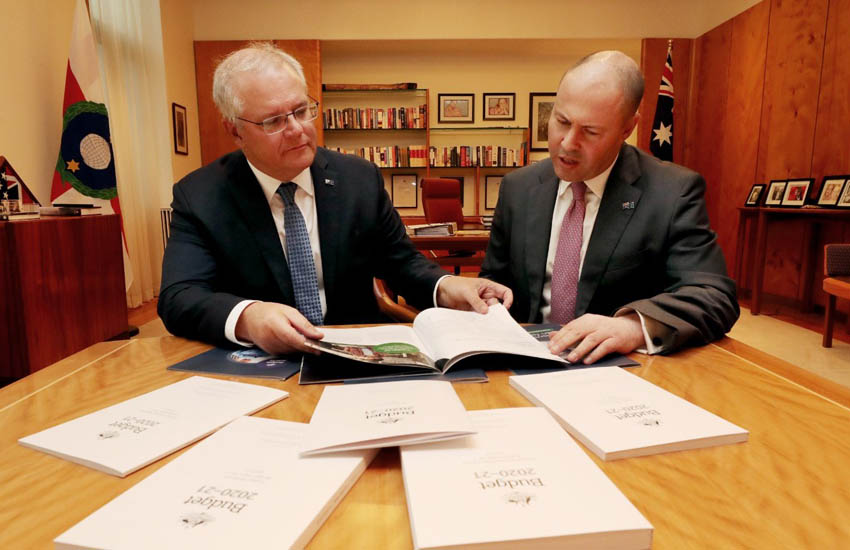

“Over 99 per cent of businesses, employing over 11 million workers, can write off the full value of any eligible asset they purchase,” said Treasurer Josh Frydenberg in his budget speech.

“This has seen their spending on machinery and equipment increase at the fastest rate in nearly seven years.

“So tonight, we again go further… so a tradie can buy a new ute, a farmer a new harvester and a manufacturer expand their production line.”

Eligibility for the temporary full expensing measure will remain unchanged, meaning businesses with a turnover of less than $5 billion will be able to deduct the full cost of eligible depreciable assets of any value as long as it is acquired after 7.30pm on 6 October 2020 and first used or installed by 30 June 2023.

No amendments will be made to rectify a discrepancy that tax experts believe will create adverse outcomes for small businesses with pool balances because they will not be able to fully expense assets on an asset-by-asset basis.

Chartered Accountants Australia and New Zealand, CPA Australia, the Institute of Public Accountants, Law Council of Australia, Tax & Super Australia and The Tax Institute had written to the Treasury earlier this year to highlight the oversight, arguing that the policy intent was to allow entities to choose whether to apply full expensing, and that there was no suggestion that it was only meant for businesses that are not small businesses with pool balances.

The extension to the temporary loss carry-back will also allow companies with a turnover of less than $5 billion to carry back a tax loss up to the 2022–23 income year and apply it against tax paid in a previous income year as far back as the 2018–19 income year.

Up to two-thirds of small businesses are set to continue to miss out on the loss carry-back because of the corporate entity requirement, despite calls from Chartered Accountants Australia and New Zealand and the National Tax and Accountants’ Association to widen the eligibility criteria to include non-corporate entities such as sole traders, partnerships and trusts.

Jotham Lian

AUTHOR

Jotham Lian is the editor of Accountants Daily, the leading source of breaking news, analysis and insight for Australian accounting professionals.

Before joining the team in 2017, Jotham wrote for a range of national mastheads including the Sydney Morning Herald, and Channel NewsAsia.

You can email Jotham at: This email address is being protected from spambots. You need JavaScript enabled to view it.

Login

Login