The new figures come from the ATO’s latest taxation statistics, which examine the 14.67 million individual tax returns for the 2018–19 financial year. These statistics are only published some time after the fact, as the ATO continues to collect data 16 months after the financial year to ensure most returns are captured.

The number of individuals claiming work-related expenses dropped from 8.95 million taxpayers in 2017–18 to 8.88 million taxpayers in 2018–19, with average claims falling by $93 to $2,331.

You’re out of free articles for this month

Total deductions for work-related expenses for 2018–19 stood at $20.7 billion — $980 million less than the previous financial year.

The fall in average claims means work-related expenses now sit at a new low not seen since 2012–13.

The reduction in work-related deductions coincides with the ATO’s tax gap program, with its first individual not in business tax gap report published in July 2018 revealing $4.4 billion lost to illegitimate, unsubstantiated or employer-reimbursed work-related expenses.

According to the ATO, such ineligible work-related expense claims account for 52 per cent of the total individuals tax gap.

As tax time 2021 fast approaches, the Tax Office has again sounded the alarm around reckless work-related claims this year.

With the current financial year being the first full year in a COVID-19 environment, the ATO has acknowledged that work-from-home expenses might increase, but it expects to see a similar drop in car and travel expenses.

“While it’s good to see most people have been doing the right thing, our data analytics will be on the lookout for unusually high claims this tax time,” said ATO assistant commissioner Tim Loh last month.

“We will also look closely at anyone with significant working-from-home expenses, that maintains or increases their claims for things like car, travel or clothing expenses.

“You can’t simply copy and paste previous year’s claims without evidence.”

Australia’s tax highlights

Accountants continue to be the preferred port of call for Australians lodging their tax returns, with 66.8 per cent opting to use a tax agent. Reliance on tax agents continues to fall, however, with a 3 per cent drop from the previous year.

Individual income tax accounts for 51.2 per cent of total tax revenue, with company income tax comprising 21.1 per cent, GST at 15.5 per cent, super fund income tax at 5.2 per cent, and fringe benefits tax at 0.9 of a percentage point.

Surgeons continue to earn the highest average income at $394,303, closely followed by anaesthetists at $385,065, while internal medicine specialists sit third with $304,752.

The median taxable income for an Australian male was $55,829, with females earning $40,547.

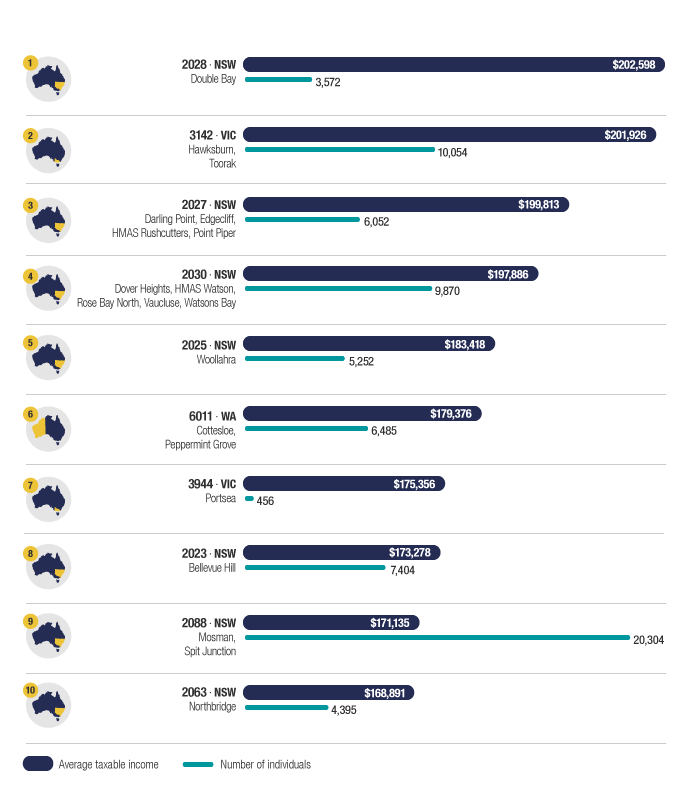

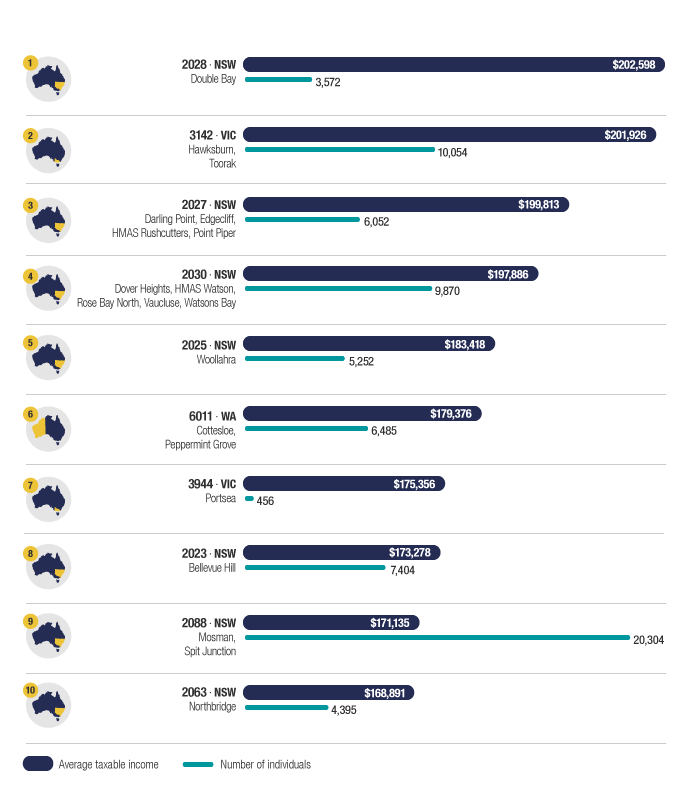

Sydney suburbs dominate the top 10 highest-earning postcodes, with seven suburbs featuring on the list, followed by two Melbourne suburbs and one from Perth.

Jotham Lian

AUTHOR

Jotham Lian is the editor of Accountants Daily, the leading source of breaking news, analysis and insight for Australian accounting professionals.

Before joining the team in 2017, Jotham wrote for a range of national mastheads including the Sydney Morning Herald, and Channel NewsAsia.

You can email Jotham at: This email address is being protected from spambots. You need JavaScript enabled to view it.

Login

Login