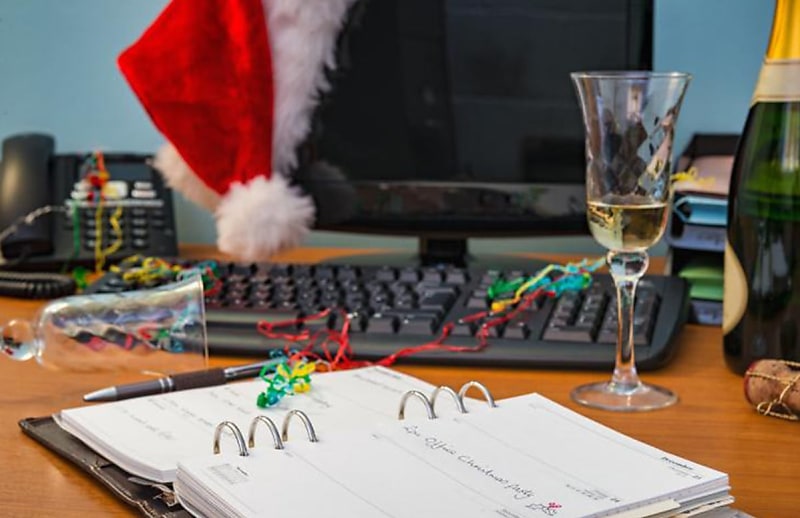

Have yourself an FBT-free Christmas

TaxIt’s fine to throw a work party and buy staff presents but give the Cartier watches a miss, say accounting bodies.

Companies going overboard on parties and gifts this Christmas will fall foul of FBT, say the professional accounting bodies, because there’s a strict limit on how much you can spend.

“It’s about the $300 rule here — the benefit you give to employees must fall under this cost,” said Elinor Kasapidis, CPA Australia’s senior manager of tax policy.

“A leg of ham or a bauble will probably be fine, but you might want to give the Cartier watches a miss.”

While that limited the price of gifts employees could receive for the holiday season, Ms Kasapidis said it did not rule out a spectacular party since these were counted separately.

“If you give your employee a gift worth up to $300 and throw a party for employees where the cost per head is under $300, both will be exempt benefits even though the combined total exceeds $300,” she said.

CA ANZ tax expert Michael Croker warned that making up for a pandemic-ruined Christmas was no excuse for exceeding the threshold.

“Christmas 2022 may be seen by some employers as an opportunity to spend bigger than normal, given the cancellation of many Christmas events during the height of the COVID pandemic,” said Mr Croker.

“But the $300 minor benefit exemption isn’t cumulative, amounts unspent in prior years don’t carry forward, so event organisers need to watch the budget.”

The associations also highlighted the benefits of hosting a firm’s Christmas party on a regular workday rather than a weekend.

“Food and drinks associated with Christmas parties will be exempt from FBT if provided to employees (not associates) on a working day on business premises and consumed by current employees,” said Mr Croker.

Ms Kasapidis said bosses also had to be wary of paying for staff rides from the party as in some circumstances they could attract FBT.

“Taxi costs to help your employees get home safely may incur FBT in some situations,” she said.

“FBT doesn’t apply if the party is held in the workplace and the taxi fare is to go home. However, if you’ve booked a venue then a trip from work to the party may be exempt but the second trip home might not be.”

Australian Small Business and Family Enterprise Ombudsman Bruce Billson said those worried about a tax sting from Christmas celebrations should get advice.

“As with so many areas of running a small business, it is important to get trusted and dependable advice,” said Mr Billson.

“Even when an employer is trying to be kind and generous to do the right thing, the rules can be complicated and compliance is still an important consideration.”

“So, when thinking of your team this festive season, get the right advice so doing something nice doesn’t turn into a tax headache.”