The Federal Court has rejected a business’ attempt to pay tax debts with a promissory note and bill of exchange for $47 and then invoicing the ATO over $187,000 for ignoring them.

Melbourne business Mesha Feet argued these unconventional methods meant the ATO’s statutory demand for repayment should be set aside because there was a “genuine dispute” over the debts owed.

You’re out of free articles for this month

However, Justice Catherine Button said a promissory note and bill of exchange were not approved means of payment for tax debts. “Payment by those means is not a means of payment approved by the Commissioner,” she said.

“The fact that there is no legislation specifying that promissory notes and bills of exchange cannot be used as means to pay tax debts is beside the point. The point is that they are not means of payment that have been approved.”

The ATO issued the statutory demand over $45,245 in tax debts Mesha Feet accumulated between 2021 and 2022.

In 2022, the company’s director Claude Tobgui attempted to discharge its 2021 liabilities by sending a document labelled as a "promissory note" to the ATO as payment that could only be redeemed at a certain location (a Coburg cafe).

It said failure to return the note within three days would be taken as acceptance of full payment.

However, the ATO “did not dispute receipt of this communication, did not respond to it, and did not attend at Twin’s Café in Coburg at the date and time specified. Nor was the ‘promissory note' returned".

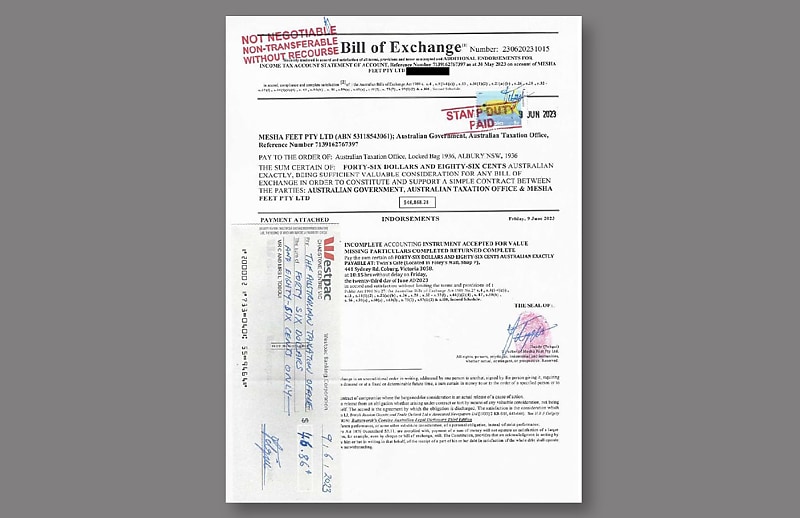

The following year, Mesha Feet then sent another letter to the ATO with a document labelled as a “bill of exchange” purporting to be payment for its 2022 liabilities. It included a cheque for $46.86, which the business claimed would be considered full payment if retained or deposited by the ATO.

The ATO ignored Mesha Feet again but deposited the cheque.

Tobgui then sent multiple follow-up letters claiming that the ATO's lack of response was an “admission of guilt” to not having evidence showing its payment methods were invalid and invoiced the ATO $187,473 for “failure to acknowledge the ‘bill of exchange’ as full and final payment of the tax liability”.

The ATO had issued public documents threatening prosecution if its notices were not complied with, Mesha Feet said, so “there should be consequences arising from the ATO’s failure to comply with notices issued by Mesha Feet”.

Justice Button said the notion that taxpayers could discharge liabilities with promissory notes and bills of exchange was “spurious” and “must be rejected”, noting that it was “not surprising” the business, represented by Tobgui, had trouble finding solicitors to advance its case.

She also called Mesha Feet’s interactions with the ATO “self-serving” and dismissed the purported invoice.

“I also do not accept that the defendant became bound to accept the ‘promissory note’ or the ‘bill of exchange’ by virtue of the ATO’s failure to return those instruments within the stipulated time frames (or at all), its failure to return the cheque, its banking of the cheque, or its failure to write back to Mesha Feet expressly rejecting the proffered means of discharging its tax debts.”

“The self-serving statements embedded by Mesha Feet and Mr Tobgui in the correspondence do not elevate the “promissory note” or the “bill of exchange” to means of payment approved by the Commissioner."

Justice Button dismissed Mesha Feet's application to set aside the statutory demand, ordering it to pay the ATO's legal costs. Mesha Feet is also facing wind-up proceedings, according to an ASIC notice in April.

Login

Login