Is renting out a room in your home taxing?

TaxRenting out a room in your home may seem innocuous but can result in some unexpected tax outcomes for those who are not informed or prepared.

Amid the national cost-of-living and housing crises, some property owners (owners) are considering innocuously renting out a room in their homes. This seemingly ticks a few boxes: it provides owners with an opportunity to receive some extra income to assist with living costs while helping out someone in need of accommodation.

However, owners who enter into such arrangements without thoroughly considering the tax implications may encounter unexpected or adverse tax outcomes. Key questions may include:

-

What’s the difference between a ‘domestic arrangement’ and a ‘tenancy agreement’?

-

What is a ‘homestay arrangement’?

-

Does it matter if non-commercial rates are charged?

-

Does it matter if the renter is family or an unrelated boarder/tenant?

-

Is the rent received always assessable?

-

Can I claim deductions for related costs?

-

Will I lose my capital gains tax (CGT) exemption when I sell my home?

Core principles

It is first useful to refresh the core principles before explaining the tax treatment in different scenarios.

-

Rental income is assessable: Ordinarily, where a taxpayer grants a lease or licence of property, whether wholly or in part, whether at arm’s length or otherwise, the amount received as rent or in respect of the licence is assessable income (see Taxation Ruling IT 2167).

-

Apportion expenses: Under section 8-1 of the Income Tax Assessment Act 1997 (ITAA 1997), taxpayers can claim deductions for losses and outgoings only to the extent they are incurred in gaining or producing assessable income. Where a property is not wholly used for rental purposes, an apportionment of the losses and outgoings incurred in connection with the rented property (related expenses) is required. Generally, apportionment should be made based on floor area.

-

Negative gearing: While various commentators continue to debate the correctness of the policy settings on negative gearing, it remains the case that, under the current law, deductions for interest on moneys borrowed to invest in rent-producing properties where the interest and other outgoings exceed the rental income in any income year are allowed in full.

-

CGT main residence exemption (MRE): Generally, the sale of your home is exempt from CGT. However, only a partial MRE may be available where the dwelling is used to produce assessable income.

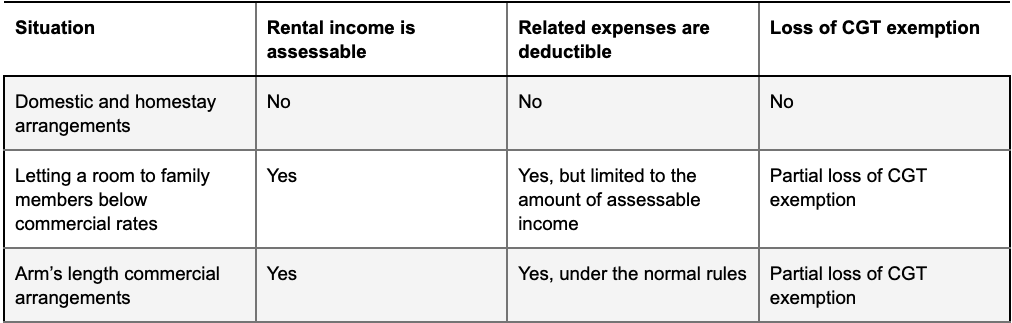

Broadly, the tax consequences of renting out a room in your home are set out in the table below. The tax outcomes for each owner depend on the specific facts and circumstances.

Types of boarding/tenancy arrangements

Renting to family members

Where property is let to relatives, the ATO’s view is that the essential question for decision is whether the arrangements are consistent with normal commercial practices in this area.

Domestic arrangements

When a family member pays for board and lodging, the ATO regards this as a ‘domestic arrangement’. Under a domestic arrangement, the occupants bear an appropriate proportion of the costs actually incurred by the owner on meals and utilities (gas, water, electricity, etc.) and the ATO does not consider that such arrangements confer any benefit on the owner. Accordingly, any rent received in the form of ‘board and lodging’ is not assessable and no deductions for related expenses can be claimed.

Such an arrangement was considered in FCT v Groser [1982] VicSC 352, where the Supreme Court of Victoria found that weekly payments of $2 (in the 1970s) were not assessable because they were a contribution to the funds out of which the taxpayer proposed to maintain his brother who required care. There was no intention to enter into, and maintain, a relationship of landlord and tenant, so the payments were not ‘rent’ under ordinary concepts.

Commercial arrangements

If the arrangement is consistent with normal commercial practices (i.e. the relatives pay market rates of rent), the owner would generally be treated no differently for income tax purposes from any other owner in a comparable arm’s length situation. That is, the rent would be assessable and related expenses would be deductible (and apportioned for private use as necessary).

Less than commercial rates

If, however, the property is let to relatives at less than commercial rates but there is a profit-making purpose, it may be that lodging is being provided beyond just a contribution to costs, in which case, a benefit arises for the owner. The rent will generally be assessable, but it does not automatically follow that related expenses will be wholly deductible.

Where the domestic or familial purpose predominates over the purpose of producing assessable income, deductions for related expenses will likely be allowed only up to the amount of rent received. In this situation, the owner cannot generate a loss or ‘negatively gear’ their home.

Renting to unrelated tenants

Tenancy agreements

Generally, an arrangement where all or part of a property is let to an unrelated tenant is a ‘tenancy agreement’. The parties enter into the arrangement with the intention of creating a relationship of landlord and tenant, with the rights and obligations this entails under state and territory laws. Typically, the arrangement is arm’s length at commercial rates, so the rental receipts constitute assessable income and related expenses are deductible. If, for example, bedroom furniture was purchased for the tenant’s exclusive use, no apportionment of the depreciation of this furniture would be necessary as it is used wholly for a taxable purpose. However, an apportionment of furniture in general living areas, as well as for the cost of utilities, would be required.

Homestay arrangements

A ‘homestay arrangement’ describes the provision of full board accommodation to local and overseas students studying or training at Australian universities or other educational institutions. The students live with a host family who provides them with meals, their own room and access to other household facilities (such as kitchen and laundry).

Amounts received under a homestay arrangement are determined by the educational institution to cover the expenses of accommodating the student in the home (see, for example, Victorian guidance). The amount of the payment is set with regard to the normal cost of supplying food, utilities and overheads for the student. The rates are not regarded as commercial rates and there is no built-in benefit component to the owner for the use of parts of their home. While some surplus may arise on occasions to the owner, these amounts will generally be small having regard to the expenditure incurred.

The ATO’s view of the tax treatment of homestay arrangements is explained in the non-binding Interpretative Decision, ATO ID 2001/381. Amounts received by the owner are made in relation to a non-commercial or domestic arrangement so they are not assessable. Similarly, no deductions are available. The ATO does not require the owner to obtain a certificate from the ATO, but it is sensible to keep a record of the homestay arrangement for any future ATO compliance activity.

Where students are taken in under a private rental agreement, not via a third party under a formal homestay arrangement, the rent may be assessable and a proportion of related expenses may be deductible.

CGT considerations

No CGT impact where domestic arrangement

There are no CGT consequences (i.e. no loss of the MRE) for letting a room to a boarder (whether a relative or unrelated) where the domestic arrangement does not give rise to assessable income for the owner.

Partial loss of main residence exemption

Where part of a home is used to produce assessable income, the owner gets only a partial MRE due to the operation of section 118-190 of the ITAA 1997, which applies where:

-

the home was used to produce assessable income during all or part of a period; and

-

if the owner had incurred interest on money borrowed to acquire the home, they could have deducted all or some of that interest.

The capital gain on the sale of the property is taxable to the extent the owner would have been able to deduct home loan interest if they had borrowed money to acquire their home (interest deductibility test). This is an amount that is reasonable having regard to the extent to which the home was used to produce assessable income (based on floor space) and for the proportionate period of time (counted in days).

The interest deductibility test is a hypothetical test and applies regardless of whether the owner did or did not borrow money to acquire their home — it does not require the owner to have actually borrowed money or incurred interest.

While renting out a room in your home may subject the property to CGT on its eventual sale, it is worth reminding clients that:

-

CGT applies only for the portion of the home that is rented out, and for the portion of time it is rented out;

-

CGT applies only to properties bought after 20 September 1985;

-

the 50% CGT discount applies to reduce the taxable gain by half where the property has been held for more than 12 months;

-

the capital gain may be reduced by available prior year or current year capital losses;

-

certain costs can be included in the cost base of the property; and

-

any taxable gain is taxed at the marginal rate of the owner in the income year in which the property is sold.

All these factors can combine to substantially reduce the capital gain. Take, for example, an owner who rents out a room in their home (15% of the floor space) for three years, out of a total ownership period of 15 years and makes a net capital gain on sale of $300,000. After applying the CGT discount, the owner would need to include a taxable gain of just $4,500 ($300,000 × 20% × 15% × 50%) in their assessable income in the year of the CGT event.

The six-year absence rule

Owners often incorrectly assume that if they rent out a room in their home for no more than six years, the absence rule is available to retain a full MRE. The length of the rental period is certainly relevant to retaining the full exemption, but so is the requirement in section 118-145 of the ITAA 1997 that the property ‘ceases to be your main residence’.

If the owner rents out a room in their home through Airbnb, Stayz or a similar sharing economy platform, and continues to live in the home, they will lose a portion of their MRE based on the floor area rented out and the length of time it was rented.

Other considerations

A range of other considerations are relevant to the process of determining whether renting out a room in your home is right for you and your family:

-

Before entering into the arrangement, the owner will need to consider:

-

the amount to be paid for the board and lodging;

-

the type of relationship with the occupant (i.e. a boarder or a tenant); and

-

the motivation, intent and benefit arising beyond a contribution towards the cost of meals and utilities.

-

Determining the allowable proportion of expenses can be tricky to work out — owners will need to correctly apportion holding costs such as interest, insurance, rates, repairs, depreciation, building allowance etc.

-

Owners need to substantiate all income and expense amounts and be able to explain how they worked out their taxable capital gain.

-

Whether the property can be negatively geared.

-

Access by the ATO to extensive data on rental activities which continue to be a focus of the ATO in its compliance activities. The ATO has visibility over:

-

rent received and declared, including data from the sharing economy platforms;

-

insurance policies;

-

mortgages/loans; and

-

residential tenancy bonds.

-

The financial impact of letting out a room on social security or pension payment recipients.

-

Undertaking background checks to ensure the suitability of the boarder/tenant and the safety of the other occupants of the household.

-

Relevant state taxes, such as the new short stay levy in Victoria, which commences on 1 January 2025 and imposes a 7.5% levy on total booking fees paid through Airbnb and similar forms of rental income. An exemption applies for the principal place of residence, including short temporary absences, which differs from the federal income tax law.

About the Author

Robyn Jacobson is the Senior Advocate at The Tax Institute.

About The Tax Institute

The Tax Institute is the leading forum for the tax community in Australia. Our reach includes membership of over 10,000 tax professionals from commerce and industry, academia, government and public practice and 40,000 Australian business leaders, government employees and students. We are committed to representing our members, shaping the future of the tax profession and continuous improvement of the tax system for the benefit of all, through the advancement of knowledge, member support and advocacy. Read more at taxinstitute.com.au