Tax

Tax

Depreciation expert urges property investors to leverage tax depreciation

Seventy per cent of people are not maximising the tax depreciation opportunities on their investment properties, a...

29 April 2025 • By Imogen Wilson

Tax

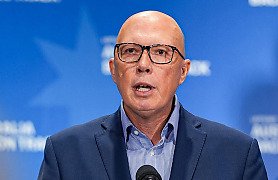

Coalition vows to scrap FBT exemption for electric vehicles

28 April 2025 • By Emma Partis

Tax

ATO responds to raft of inquiries on Bendel decision

24 April 2025 • By Miranda Brownlee

more from tax

Tax

Coalition unveils new tax incentives as part of small business package

The party has released further details on its plans for small and family businesses, including a tapered tax offset...

23 April 2025 • By Miranda Brownlee

Tax

ATO to appeal ART decision on truck driver’s meal expenses

The Commissioner of Taxation has filed a notice of appeal in the Federal Court against a decision concerning...

22 April 2025 • By Miranda Brownlee

Tax

Under the Hood: Are you maximising your tax depreciation opportunities?

This week on UTH, Imogen is joined by Brad Beer, chief executive of BMT Tax Depreciation, to dive into the world of...

22 April 2025 • By Robyn Tongol

Tax

ASFA’s land tax analogy and Div 296 ‘falls short’: industry leader

Remarks by ASFA chief executive Mary Delahunty that the Division 296 tax is similar to land tax “simply doesn’t hold”,...

22 April 2025 • By Keeli Cambourne

Tax

$1k deduction to eliminate hours of ‘low-margin, high-risk work’, accountants...

Accountants have voiced their support for Labor’s $1,000 standard deduction following criticisms against the measure...

17 April 2025 • By Imogen Wilson

Tax

Labor’s standard deduction may expose taxpayers to ‘future tax consequences’

The $1,000 instant deduction could see taxpayers miss out on critical conversations with their accountant, exposing...

15 April 2025 • By Miranda Brownlee

Tax

Under the Hood: Joanna Perry and her mission to guide the next generation of...

This week on UTH Imogen is joined by Joanna Perry, industry advocate and ex-business adviser turned business owner....

15 April 2025 • By Robyn Tongol