Weaponised 100A needs a rewrite: CA ANZ

“Unsatisfactory for all concerned”, accountants body says of trust ruling.

“Unsatisfactory for all concerned”, accountants body says of trust ruling.

Compliance teams face work overload, stress and anxiety as they grapple with onerous demands, a report...

The 2022 Tax Season is here, get your team prepped to visualise value for clients, build revenue for you and launch...

The ATO says the best protection is “knowledge defence”.

The Tax Office needs to use more of its powers to recover superannuation payments, the national auditor...

Contributions to political parties need to be factored into tax returns, says CA...

The deal will provide customers with tax default data so that they can assess debt risk more...

Revised standards that apply at the end of this year involve a complete rethink, SMSF conference hears.

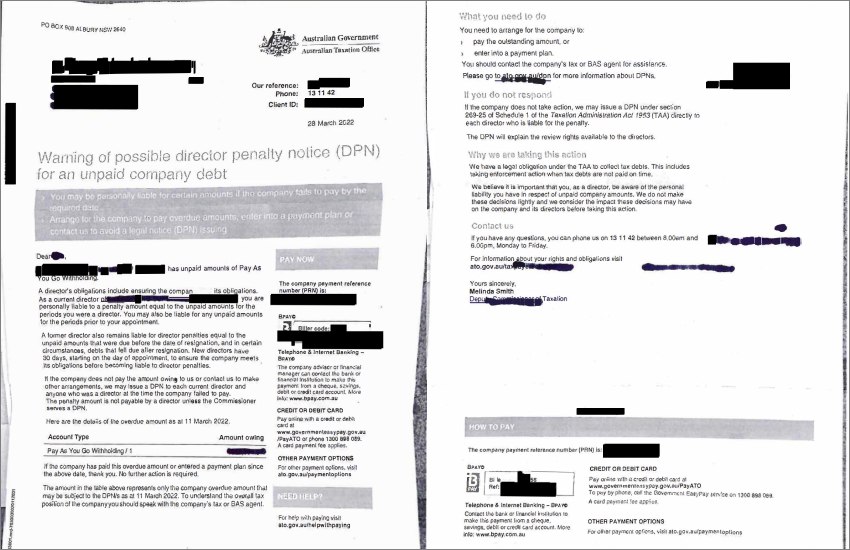

The clock is ticking for thousands who were given a stern warning by the ATO to act on their tax liabilities late last...

There has been an increase in scams where fake websites offer to provide business application services for a...

The cost of advice is expected to grow as the number of adviser exodus continues, a report...

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login