Promoted by AccXite.

With the introduction of Single Touch Payroll (STP) from 1 July 2019, all businesses need to use a ATO approved software. Find out how you can get free access until next year from one of the providers.

Promoted by AccXite.

With the introduction of Single Touch Payroll (STP) from 1 July 2019, all businesses need to use a ATO approved software. Find out how you can get free access until next year from one of the providers.

From 1 July 2019, small businesses have to submit every payment to their employees on an on going basis using an ATO approved software under the Single Touch Payroll (STP). The software vendors are charging a monthly subscription mainly based on the number of employees in the business. Introduction to single touch payroll has put businesses under enormous pressure to select a suitable software that meets their needs, budgets and ambitions.

Beware of additional fees

While there are many software providers providing the STP software, most of them cost more than what you as a small business owner is willing to pay for it. On the top of it there are hidden fees like set up fees, support fees, maintenance fees, and exit fees that might creep up on you if you are not careful.

One thing that could help you with this situation would be a free trial. You get to try the software and if it suits your needs, you stick with it.

Don’t Give the credit card details

Beware of software providers who are asking for the payment details or credit card details upfront. If you register with them, it is harder for you to get out even if you don’t like the software. They automatically charge you if you don’t give them a minimum termination notice period, usually 30 days. If they haven’t got your credit card details, it would be easier for you to get out.

Don’t accept 30 day trial periods

Another trick that could be played on you is offering you a 30 day trial period. A 30 day trial period for a payroll software is not simply enough. You will need a minimum of 4 months to ensure that the software is suitable for you.

You have quarterly obligations such as Superannuation and PAYGW payment. You need the software to prepare these reports. How can you ensure that the software can deal with these requirements adequately, if you don’t use it over a full quarter period?

Also, if the trial period is only 30 days, you need to notify them in writing that you are not going to use their product on the very first day you sign up. If not, because of failing to give the 30 day notice, they will charge you a minimum of 1 month fees.

Why AccXite is different

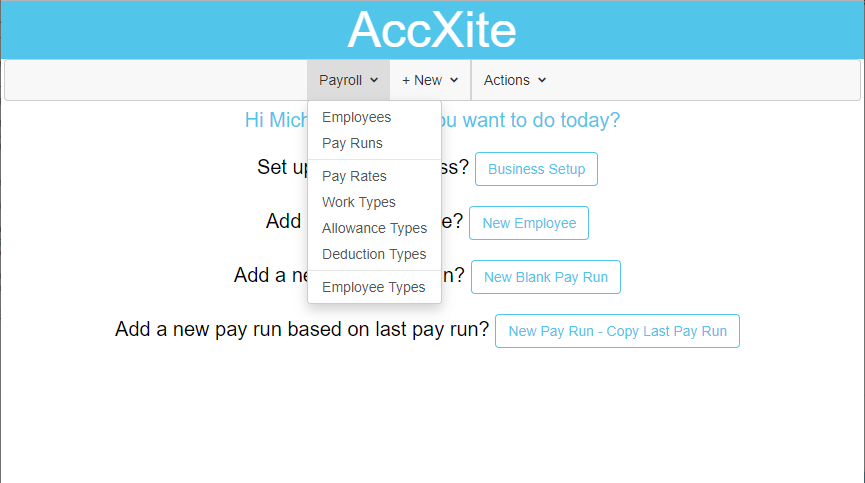

Only one software provider, AccXite is acknowledging these issues and offering all businesses a free trial (no strings attached) until 31 Dec 2019. So instead of the minimum required 4 months trial, you get at least seven months (if you register now) to test the product. There are no setup, maintenance, support or exit fees. You don’t need to give your credit card details to AccXite during the trial period. AccXite will fulfil all your reporting obligations and if you are not happy during the trial period, you can just simply close the account.

Our recommendation

Given that you can trial the product for a longer period, you should try AccXite first. If the software is suitable for your needs, then you don’t need to pay anything until 31 December and keep going. If the software is not suitable for you, you can just simply close the account and then try another software. You can start the trial for AccXite here.

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login

You are not authorised to post comments.

Comments will undergo moderation before they get published.