Promoted by GreatSoft

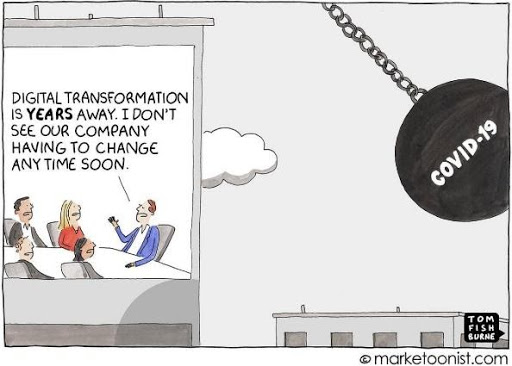

The world has changed. The way we work and serve our clients has changed in ways we could not have imagined a few short months ago.

Promoted by GreatSoft

The world has changed. The way we work and serve our clients has changed in ways we could not have imagined a few short months ago.

For accountants, this is a particularly challenging time. Not only do you need to manage internal changes with staff working from home, but also advise and help your clients navigate their own business challenges.

Whilst firms transitioning to the cloud are at different stages of their digital journey, there is no doubt that recent events and WFH arrangements have caused firms to re-look at their systems, processes, technology, and methods of communication and re-evaluate what might be needed in the future to support clients and staff in this changing environment.

Will the world of remote work be the new norm for accounting firms in the future?

The answer is most likely yes, as the world-wide trend to remote work continues to grow rapidly - Globalworkplaceanalytics-telecommuting-statistics

In this new norm, processes and choice of technology platform will play a key role in a firm's ability to function efficiently and effectively.

Strategic choices to consider

1. Wait and see or make a decision to transition to the cloud.

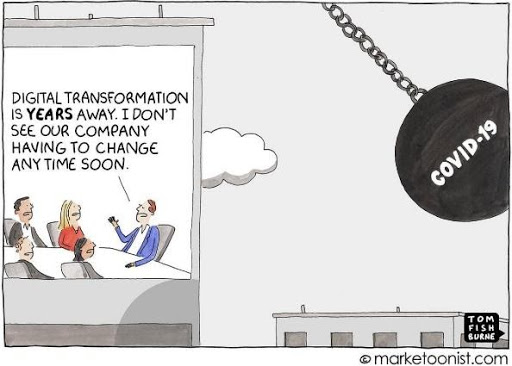

Accounting firms are in various phases of the technology adoption cycle, with many of the innovators and early adopters being smaller firms who are already enjoying the benefits and productivity gains in moving to the cloud.

Of course, it is easier for smaller firms to decide to change as there are not so many moving parts and dependencies in these firms. The other reason is that larger firms have been rather limited in choice, particularly when it comes to enterprise cloud practice management solutions (until now).

The early majority are now starting to make a move and looking at alternatives, whilst the late majority may choose to wait and see what their incumbent provider is promising to deliver down the track, and the laggards will hold out till the very end.

“Those with genuine cloud products have already moved on to what’s next. Those languishing on desktop or “hybrid” offerings are focused on getting to the Cloud. There is next to no chance of catch up, as the rate of change is increasing.

The trend in 2019 is the newer players with genuine, born-in-the-cloud solutions (Xero at the lower end and Salesforce and GreatSoft at the top end) are now gaining serious momentum and it appears, are accelerating away at a rate of knots”. * Matt Paff - (Here is the source link to 8 Trends in the accountants software industry)

The question for the late majority and laggards is how long do you wait and what is the opportunity cost of waiting?

2. Desktop or Cloud – Most accountants are still using a lot of desktop applications, particularly Practice Management and Tax.

The younger generation of accountants in the firm have grown up a digital world and expect their work-place to be using modern technologies. The accounting industry has been one of the slowest to move to a digital world and is trying to play catch up now.

A decision to move to the cloud is more than just about savings on Citrix, IT infrastructure, management, and other licence costs.

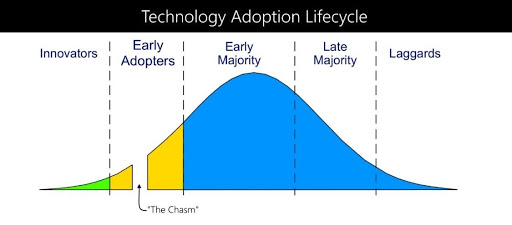

Cloud unleashes the power of centralised data by allowing integrations across platforms, mobility, better insights, increased overall visibility and a single unified view of the firm’s client

|

Emerging technologies that require the cloud:

all rely on centralised quality data |

|

3. Single vs Multi-vendor solutions

The advent of cloud technology has led to an ever-increasing number of cloud apps to address specific gaps in the accountants app stack.

With things changing so fast, it is no longer possible for a single vendor to be able to have the budget, domain expertise, and resources to produce software that addresses all the technology needs of the modern-day accounting firm.

Freedom of choice and having access to such a wide range of practice apps has resulted in what Matt Paff has referred to as “App Fatigue” with firms struggling to stay abreast of all the apps being used across the practice and to make things worse, each new unintegrated App creates another data island which is difficult to manage and keep updated

**Matt Paff Accountants App stack

**Matt Paff Accountants App stackIf systems aren’t integrated, the result is an ever-increasing number of disparate databases with data consistency and integrity issues.

At least this is the argument being put forward by single-vendor solution providers who traditionally have provided a complete integrated suite of applications, with “one throat to choke” as it were.

Whilst this was a valid argument with the obvious benefits a fully integrated suite of applications brings, that strategy is reliant on all of the applications in that suite being best in class, otherwise, you have to forego functionality and efficiency to have a fully integrated suite of applications.

The world has changed - Integration in 2020 isn’t what integration was a decade ago and integrated “best-of-breed” technology stacks are far more effective and easier to achieve and support now than in years past.

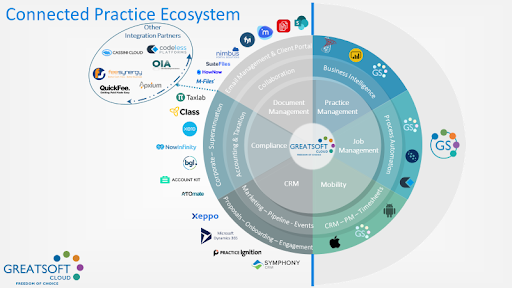

A unified client view is redefining the core argument over “all-in-one” vs “best-of-breed” and according to industry experts, closed ecosystems will ultimately lose out to choice.

4. Why transition to the cloud

API’s and integrations across platforms

The challenge for firms is…..

This is very difficult to achieve when trying to integrate legacy desktop systems with cloud solutions.

Platforms that embrace integration, that support behavior and process change will give firms a competitive advantage and enable the digital transformation firms of tomorrow are seeking.

GreatSoft is a scalable cloud Practice Management and data aggregation platform that helps solve complex problems in the Accounting Industry.

Secure the future of your practice – Book a free discovery consultation with us today.

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login

You are not authorised to post comments.

Comments will undergo moderation before they get published.