Selling on multiple digital platforms helps clients reach customers, but the data can be a headache for accountants. Managing it begins by automating what can be automated. Insights brought to you by Dext.

Selling on multiple digital platforms helps clients reach customers, but the data can be a headache for accountants. Managing it begins by automating what can be automated. Insights brought to you by Dext.

During a time when access to bricks and mortar stores is haphazard and reaching customers often means going to where they shop, rather than having them come to you, a multi-channel digital sales strategy is often essential for retailers. However, such customer convenience frequently results in accounting inconveniences. A client with multiple online platforms and retail points requires more cumbersome journal entries and greater complexity of compliance.

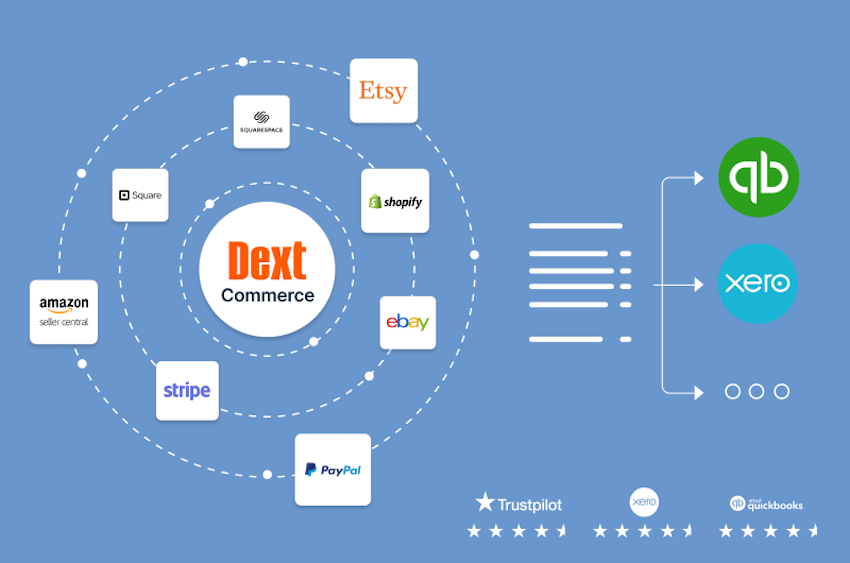

The first and best step to overcoming such challenges is automating manual tasks that can be automated. This is the value of a digital sales aggregator. It automatically fetches and consolidates sales transaction data from various ecommerce and point of sale platforms, streamlines tax compliance and saves accountants valuable time and effort.

"Accountants don't need to spend time on tedious tasks like capturing the right amounts of GST.”

Nattika Munro CA, Senior Practice Solutions Expert, Dext

Nattika Munro CA, senior practice solutions expert at accounting software provider Dext, says a digital sales aggregator also helps accountants become powerful advisers to their clients.

“As a former digital advisor, I know clients are looking for more than just compliance services,” she says. “Tools such as Dext Commerce free up valuable time and provide the real-time insights accountants and bookkeepers need to add more value to client relationships.”

A single source of truth

The right digital sales aggregator simplifies the collection and categorisation of sales data from multiple ecommerce, point-of-sale and payment platforms – Dext Commerce, for example, handles data from platforms including Shopify, Stripe, and Square. The data is consolidated and standardised in the platform and transferred directly into software such as Xero or Quickbooks via a seamless integration.

“It connects sales platforms together in one place, which simplifies workflows and provides real-time reconciliation, so as advisors, we can accurately assess cut-off dates, cash and accrual based accounting methods and deferred revenue,” says Munro.

Beyond providing a single source of truth for all your information, the right digital sales aggregator can also capture all the line-by-line financial data attributed to a transaction, says Munro.

“This means accountants don't need to spend time on tedious tasks like capturing the right amounts of GST.”

Cross-border sales are a wonderful way to expand your customer base, but also add a layer of complexity to tax compliance. This too can be simplified through automation. The correct domestic or international tax rates can be applied at the point of sale.

Munro says that digital sales aggregators such as Dext Commerce allow accountants to set rules for handling default tax settings, including region or market data fields that your accounting platform may not be set up to handle.

“For example, if an Australian-based retailer is selling to the UK or the US, the platform can show whether GST needs to be attributed, so accountants can properly address tax compliance,” says Munro.

From number crunching to consulting

The ultimate value of automatically importing and categorising data within a single platform is that, after freeing accountancy businesses from a lot of manual work, the platform provides greater visibility of client data, which can be analysed to provide useful business information.

“Being able to see who a client’s customers are and and what products those customers are buying, for instance, allows accountants to provide deeper analysis and advice,” says Munro.

“Digital sales aggregators take away the manual, time consuming, tedious task of attributing the right revenue, the right tax for the right region and the associated fees that come with individual transactions. With this kind of platform in place, an accountant can be more productive, provide more valuable insights, and be in a position to service digital sales clients.”

Want to learn more about how to handle digital sales data for your clients? Visit https://dext.com/au/

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login

You are not authorised to post comments.

Comments will undergo moderation before they get published.