Business

Cross-border partnership creates Canadian CPA pathway

An agreement between CIMA and CPA Canada fast-tracks reciprocal membership between the two bodies.

11 August 2023 • By Christine Chen

Business

Rise in listings could see ‘mild deterioration’ in housing market,...

11 August 2023 • By Miranda Brownlee

Tax

Certainty over tax residency rules ‘will come at a cost’

10 August 2023 • By Philip King

more from tag

Regulation

Kilimanjaro wins temporary reprieve on MYOB Exo margins

Federal Court grants injunctions preventing software developer from withholding licences or pursuing the reseller for...

10 August 2023 • By Philip King

Technology

Ignition feature puts the profit back into scope creep

Instant billing facility enables practices to charge for ad hoc or additional work without a fresh client proposal.

10 August 2023 • By Philip King

Regulation

Bikie gang members charged over alleged GST fraud

Joint AFP and ATO action over tax scams serve up leads to other crimes, deputy commissioner says.

10 August 2023 • By Philip King

Appointments

Mackay Goodwin appoints bankruptcy division head

The firm’s director expects an uptick in insolvencies amid high interest rates and an ATO director crackdown.

09 August 2023 • By Christine Chen

Business

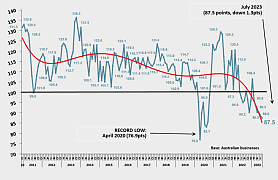

NSW leads plunge in business confidence to record lows

Six-month run in negative territory means economic pessimism has hit pandemic levels, Roy Morgan survey finds.

09 August 2023 • By Christine Chen

Technology

Data hacks set off alarm bells about privacy, survey finds

Nine out of 10 want stronger controls over what information can be collected and how it is held.

09 August 2023 • By Philip King

Regulation

Stadium cleaners hit with $330k in fines for worker underpayments

FWO investigated the case after an anonymous tip-off and found flat rates as low as $7 an hour.

09 August 2023 • By Philip King

Regulation

Government action on tax adviser misconduct ‘a positive step’

A reform package aimed at improving the integrity of tax system and profession has been welcomed by the Tax Institute...

08 August 2023 • By Miranda Brownlee

Business

EY acquires design and product development firm

EY Australia will look to expand its products and services through the acquisition of a product development and...

08 August 2023 • By Miranda Brownlee

Business

Business growth ‘resilient’ despite economic headwinds: COSBOA

Growth rates across Australian businesses is still at pre-pandemic levels despite slowing sales and escalating...

08 August 2023 • By Miranda Brownlee

Tax

Most taxpayers ‘in the dark’ about their return result

Widespread disappointment about refunds – or even money owing – should be unsurprising, according to a CPA Australia...

07 August 2023 • By Philip King

Super

ATO urged to postpone tax determination on NALI and CGT

The ATO must delay its tax determination concerning non-arm’s length income and capital gains tax until the non-arm’s...

07 August 2023 • By Miranda Brownlee

Business

Carbon Group adds Harding Martin to Qld offices

The boutique firm becomes the group’s fourth office in the Sunshine State following growth last year in South Australia.

07 August 2023 • By Philip King

Business

Poor culture ‘root cause’ of company failures

Staff turnover, product recalls and tighter credit are typically symptoms of a more profound issue, says turnaround...

08 August 2023 • By Philip King

Business

Food production crisis to feed insolvency backlog

An economy in strife means farming, as well as retail and construction, will add to the number of pandemic zombie...

07 August 2023 • By Philip King

Regulation

AFP ‘had insufficient information from ATO to pursue PwC’ in 2018

Sample documents were supplied by the Tax Office five years ago but it was only in May that Treasury reported a crime...

04 August 2023 • By Philip King

Regulation

Director faces jail for dishonest handling of $500k in SMSFs

The lure of “property developments” persuaded investors to set up SMSFs then move funds into two companies controlled...

04 August 2023 • By Philip King