‘Huge opportunity’ for bookkeepers with STP

Bookkeepers have been urged to get their clients onto Single Touch Payroll before the end-of-financial-year rush, with...

Bookkeepers have been urged to get their clients onto Single Touch Payroll before the end-of-financial-year rush, with...

Most Australians find that a lack of recent experience means that re-entering the workforce after a career break...

Over $100 million in superannuation has been reunited with employees, with 19,000 employers coming forward since the SG...

Clients intentionally or recklessly misrepresenting employment relationships as independent contracts will soon find it...

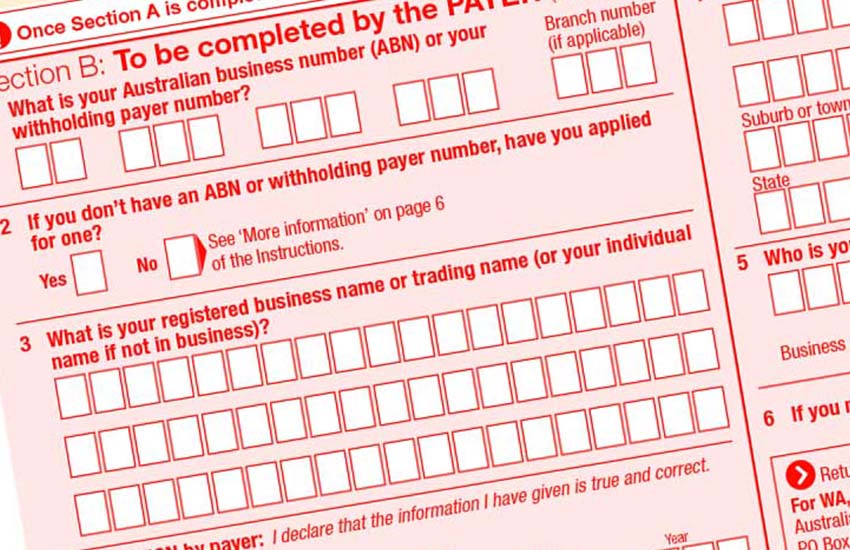

The government has been called to release details on how it aims to introduce new ABN requirements to ensure details...

More effective supervision by the Tax Practitioners Board and the professional associations to manage conflicts of...

CPA Australia has joined CA ANZ in lodging an application to have its program recognised and accredited as approved...

Dumping the accountants exemption has created a hole in the market for Australians who have simple advice needs, the...

Bookkeeping clients that will soon be covered by the taxable payments reporting system regime can expect letters from...

The tax office is expecting practitioners to help work alongside them to help get small employers up to speed on their...

SMSF trustees who previously obtained private binding rulings from the ATO for related party borrowings on...

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login