ATO details STP exemptions

BAS agents can help their clients apply for exemptions from Single Touch Payroll for certain scenarios, including...

BAS agents can help their clients apply for exemptions from Single Touch Payroll for certain scenarios, including...

Accountants disgruntled with the rising regulatory burden on the profession will soon be able to voice their feedback,...

More than one in 10 small businesses faced debt recovery action from the ATO while their tax disputes were before the...

Promoted by Wolters Kluwer. Looking at and reviewing changes to the tax law in Australia can be both simple and...

Bookkeepers and accountants who have clients with outstanding superannuation guarantee obligations have been urged to...

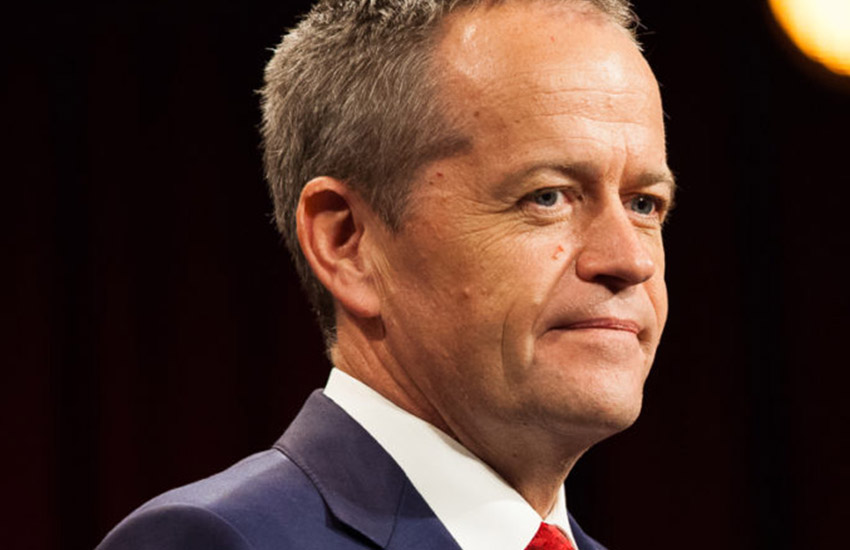

Opposition Leader Bill Shorten’s plan to restore weekend and public holiday penalty rates and to allow casuals a...

Emergency director appointments at CPA Australia will need to be followed by an extraordinary general meeting, while...

A South Australian restaurateur is in trouble with ASIC after a liquidator found that he had pocketed a portion of the...

The corporate regulator has banned a Perth-based accountant from providing any financial services for six years after...

Accountants have been urged to remind their business clients on new superannuation guarantee integrity measures that...

It has been almost a year since the notifiable data breaches legislation came into effect, and in this time, the ATO...

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login