ATO investigation recovers $42m in illicit tobacco operation

The Australian Taxation Office (ATO) has helped secure another win in a major illicit tobacco operation.

The Australian Taxation Office (ATO) has helped secure another win in a major illicit tobacco operation.

The new changes to the AAT’s power to modify ATO debt recovery action will further strain the resources of the AAT...

With the ATO closing its professional-to-professional (P2P) mailbox in late December, the Tax Office has advised SMSF...

Time to turn off paper from the ATO? New tech tools remove compliance burden for managing client communication...

The Australian Small Business and Family Enterprise Ombudsman (ASBFEO) has welcomed draft legislation from government...

The government has released new draft legislation that will allow small businesses to contest the ATO’s collection of...

Your clients may be riding the economic recovery ‘wave’ – but will their ATO debt wipe them...

The ATO will undertake a review of the advance pricing arrangement (APA) program in 2022 to improve how the service is...

A national body has called on the ATO and politicians to address super contribution in Queensland, with new analysis...

The government will provide an additional $111 million in funding to the ATO on its personal taxation compliance...

The ATO says a higher level of scrutiny has seen significant improvement with tax compliance among large corporations,...

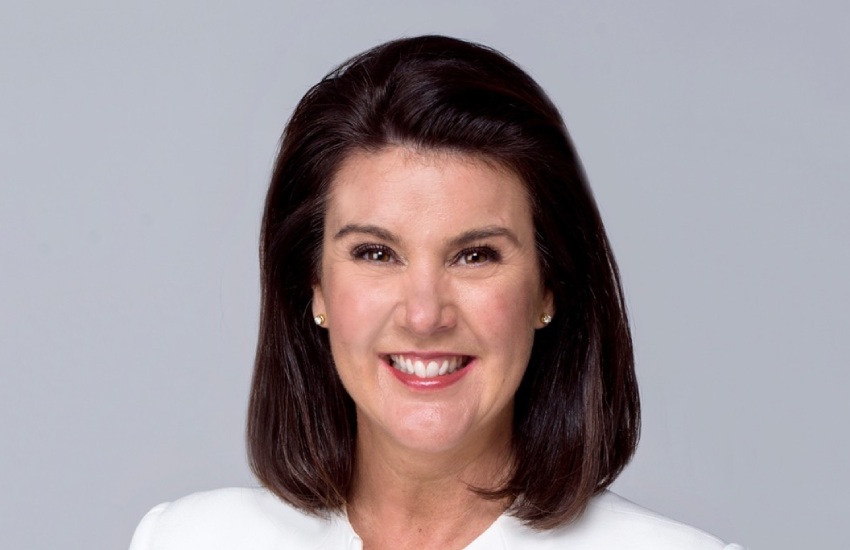

Senator Jane Hume, the Minister for Superannuation, Financial Services, and the Digital Economy and the new Minister...

Australia’s tax ombudsman has launched three new investigations across 2022, including one into how the ATO...

Last year, Accountants Daily’s flagship forum attracted over 400 senior accounting professionals for a day of...

KNOW MOREGet breaking news

Login

Login