ATO to offer new lodgement support in September

The ATO will soon allow tax agents to request for extra time to lodge for up to five clients as it recognises the...

The ATO will soon allow tax agents to request for extra time to lodge for up to five clients as it recognises the...

The Tax Commissioner has refused to comply with a Senate order that would have revealed over 10,000 businesses that...

The Tax Office says businesses that made significant changes to their wages in order to obtain a higher amount of the...

In case you missed it, the ATO sent out a disturbing message yesterday warning property investors that they shouldn’t...

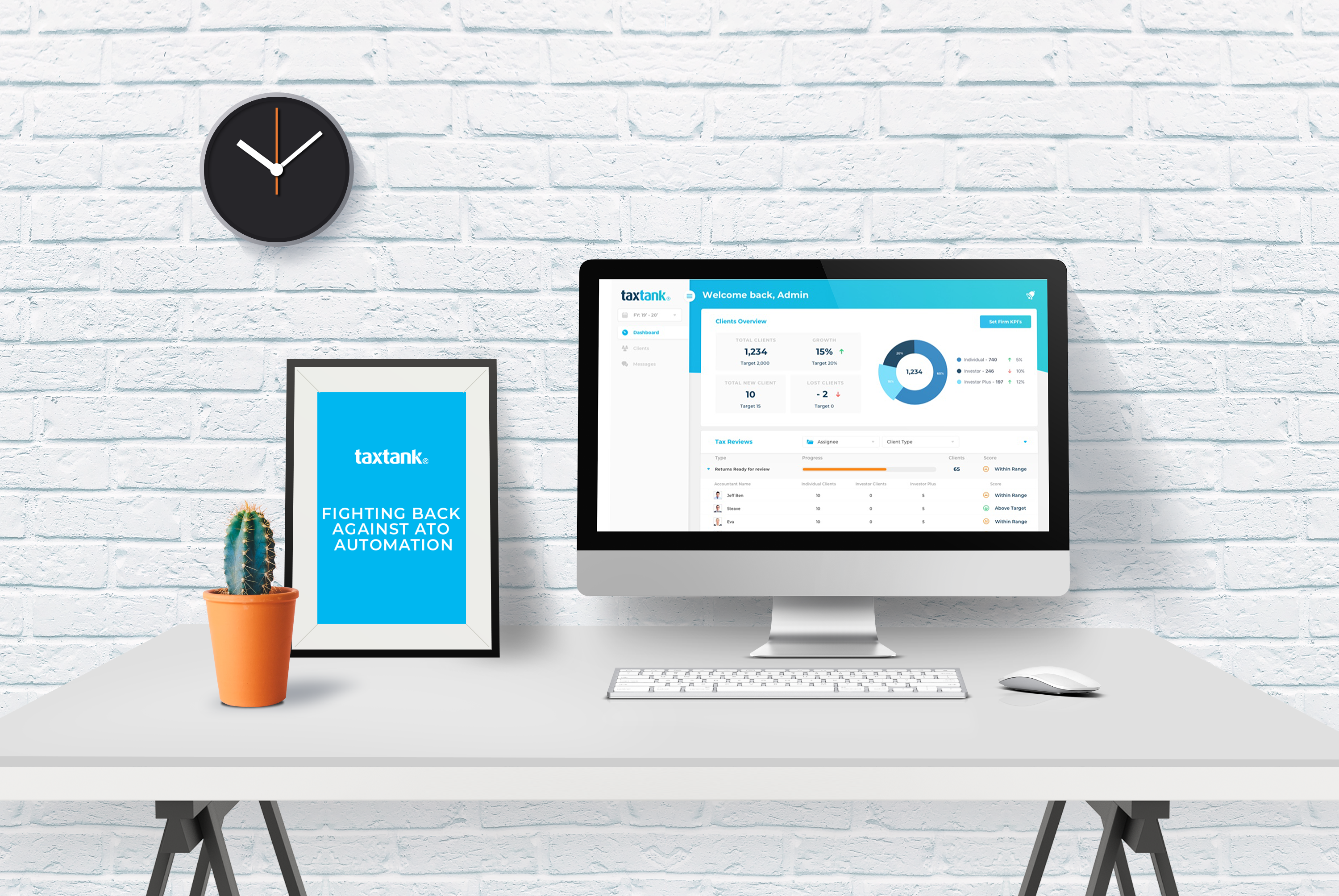

It’s pretty obvious the ATO are charging ahead with an agenda of automation to change the accounting industry...

The ATO has confirmed its consultative approach for the transition to digital client communication – is your...

Join us as we unpack what the roll-out of e-invoicing will mean for the accounting and small-business community with a...

The new service will see the ATO provide hands-on guidance on significant commercial transactions as the government...

The ATO has unequivocally declared that it will not use e-invoicing to facilitate tax compliance, despite fears that...

Legislation that will create a new watchdog to scrutinise Australia’s twin-peaks financial regulator model has now...

The ATO is currently investigating ongoing issues with Online services for agents after some practitioners were locked...

The ATO will delay the retirement of eSAT for SMSF auditors as it plans additional functionality updates for Online...

Three prominent accountants and two senior ATO officers have been recognised in the Queen’s Birthday 2021 Honours...

Last year, Accountants Daily’s flagship forum attracted over 400 senior accounting professionals for a day of...

KNOW MOREGet breaking news

Login

Login