Scrap tax returns and save on accounting fees, says think tank

Australia should introduce an opt-in standardised $3,000 deduction covering work-related expenses and other personal...

Australia should introduce an opt-in standardised $3,000 deduction covering work-related expenses and other personal...

Chartered accountants have taken aim at the ATO’s “out of touch” approach to the allocation of professional firm...

A Perth man could face up to 22 years in jail for impersonating an ATO officer and failing to declare $7 million in...

Businesses struggling with tax debts have been urged to re-engage with the ATO as it pledges not to “destroy the very...

Introducing a corporate tax concession, flexibility for entrepreneurs who don’t spend the entire financial year in...

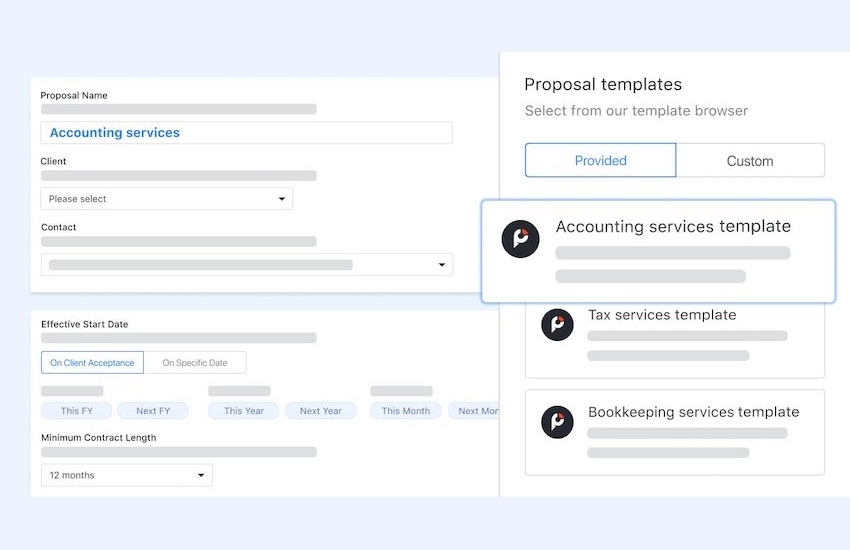

Tax agents who continue to base their value and business model around the traditional tax return will struggle as the...

Practitioners providing tax financial advice will no longer need to be registered with the Tax Practitioners Board...

Draft legislation for two federal budget announcements last October has now been released, including measures to exempt...

The ATO’s failure to consult with peak professional bodies in developing its draft allocation of professional firm...

A tax agent who amended tax returns without consulting his clients, failed to pay personal tax debts and misled members...

Offering fringe-benefits tax returns to your clients mitigates risk of audit exposure - we’ve now made it even...

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login