Victoria targets property investors with tax measures worth $2.7bn

In a pre-budget announcement on Saturday, the Andrews government said it will move to hike land tax and stamp duty in...

In a pre-budget announcement on Saturday, the Andrews government said it will move to hike land tax and stamp duty in...

The delivery of the research and development tax incentive is set to undergo scrutiny by the Board of Taxation as the...

Businesses that fall into the Top 500, Next 5,000, and medium and emerging private groups programs should be on guard,...

While the government’s newly announced reforms to individual tax residency emerge as a positive step towards boosting...

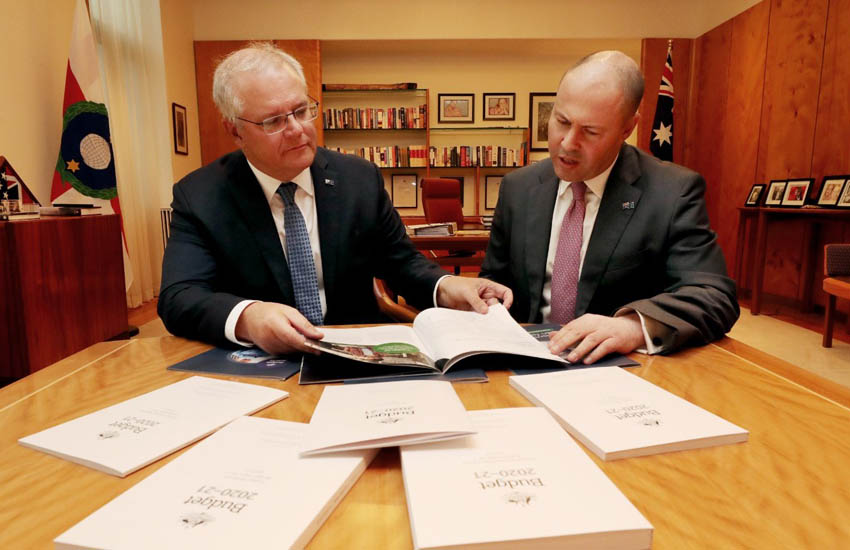

The government will extend the temporary full expensing and loss carry-back measures for a further 12 months as it...

Up to 10.2 million workers will continue to benefit from a $1,080 tax offset for a further year as the government locks...

Individual tax residency rules and the tax treatment of employee share schemes are set for an overhaul as the...

Not-for-profit entities will soon have to disclose why they should be exempt from income tax as the government turns to...

Close scrutiny of a Tasmanian man’s internet browsing history has led to him being denied his work-related expense...

A mid-tier firm has called for fringe benefits tax to be scrapped, starting in regional Australia, arguing that the...

Small businesses will now be able to pause ATO debt recovery action through the Administrative Appeals Tribunal as part...

Uncover a new world of opportunity at the New Broker Academy 2025If you’re ready for a career change and are looking...

KNOW MOREGet breaking news

Login

Login